The future of the Metaverse holds great promise. The present, less so.

Accounting Today

AUGUST 25, 2022

Accounting Today

AUGUST 25, 2022

TaxConnex

AUGUST 25, 2022

Consistent (i.e., “good”) service is a nice thing to have in any industry. In a field that changes as fast as sales tax, it’s a necessity. But providers have their own business priorities as well and if customer service isn’t at the top of their list, changes could end up harming you. Maybe they’ve priced themselves out of your range or discontinued the service you need, or have become too big to match your specific needs.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Acterys

AUGUST 25, 2022

This month, we are again releasing major improvements for Acterys. Our development team has been pretty busy working on significant functionality improvements and new features to make your experience with our products better in terms of speed, usability, security, and ease of use. We have added multiple new features, new Apps, upgraded Power BI visuals with refined functions, and enhanced overall application security.

Withum

AUGUST 25, 2022

On August 24, 2022, the IRS issued Notice 2022-36 to announce broad-based penalty relief for certain failure to file penalties with respect to tax returns for taxable years 2019 and 2020 as long as they are filed by September 30, 2022. The Notice also provides relief from certain information return penalties with respect to taxable year 2019 returns that were filed on or before August 1, 2020, and with respect to taxable year 2020 returns that were filed on or before August 1, 2021.

Advertiser: Paycor

HR doesn’t exist in a vacuum. This work impacts everyone: from the C-Suite to your newest hire. It also drives results. Learn how to make it all happen in Paycor’s latest guide.

Intuitive Accountant

AUGUST 25, 2022

Payroll are not the only apps we're covering in our Payroll & Benefits miniseries. That's why our first Benefits feature is 401GO, whose self-declared mission is to ensure every American is retirement ready.

Xero

AUGUST 25, 2022

In just a couple of weeks, accountants and bookkeepers from all over Australia, New Zealand and Asia will descend upon Sydney’s International Convention Centre (ICC) for two days of inspiration, education, connection and fun. You guessed it; we’re talking about the return of Xerocon! After a three-year hiatus, we couldn’t be more excited to bring you – our partner community – together again at the world’s most beautiful and innovative conference for cloud accounting leaders. .

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

ThomsonReuters

AUGUST 25, 2022

QUESTION: Many of our employees do not have computer access for their jobs. Can we provide SPDs for the company’s ERISA health and welfare plan to those employees using a flash drive, CD, or something similar that they can use on their home computers instead of mailing paper copies? ANSWER: In general, welfare plan SPDs (and other ERISA disclosures) may be furnished electronically to employees without work-related computer access if certain requirements are met, including obtaining the employe

Going Concern

AUGUST 25, 2022

*post image is not Steve, just some guy from iStock. Letters to the editor are great because they clue you in to how a reader identifies with what you’ve written and often the writer will share their own experience viewed through the lens of your story. In this case, the reader-submitted letter we’re about to share with you was written not to us but to Fortune in regards to this August 15 article about the struggle to find accounting and finance talent (we wrote our own take on Delo

ThomsonReuters

AUGUST 25, 2022

FAQs About Affordable Care Act and Consolidated Appropriations Act, 2021 Implementation Part 55 (Aug. 19, 2022). Available at [link]. The DOL, HHS, and IRS have released FAQs (Part 55) addressing a wide variety of issues raised by the surprise medical billing rules enacted as part of the Consolidated Appropriations Act, 2021 (CAA). (The agencies simultaneously released surprise billing final regulations addressing a narrow set of independent dispute resolution (IDR) issues.

Intuitive Accountant

AUGUST 25, 2022

Tipalti’s Rob Israch explains why this year may be one of the most complex tax seasons for these types of contractors and their employers.

Speaker: James Kahler, COO of Full Course

Ever wondered where to splurge and where to safely conserve when it comes to operating and growing your restaurant? 🤔 Join James Kahler, COO of Full Course and industry visionary, in this new webinar where he'll talk all about best practices to invest in your restaurant's success! Whether you're a new business or an established restaurant, a seasoned pro or a rookie, you'll learn the keys to sustainable success in this competitive industry.

Patriot Software

AUGUST 25, 2022

Sometimes, being an employer feels like you’re doing nonstop math. And if you want to know how to convert salary to hourly rate for employees, it’s time to whip out those calculators. So, when would you need to convert a salary to hourly wages? You may want to know how an employee’s salary compares to […] READ MORE.

Intuitive Accountant

AUGUST 25, 2022

New inventory features and a strategic partnership with Avalara will help bring invaluable sales tax capabilities to Xero.

Xero

AUGUST 25, 2022

It’s been so amazing to bring our long-awaited Xerocon event back to life in New Orleans over the past two days. This vibrant city brought a festive atmosphere to the event and we were inspired with on-stage performances by local talent such as Amanda Shaw , a fiddler and Brandan Odum , a successful street artist. It was the perfect way to reconnect with our US and Canadian based accounting and bookkeeping partners and the wider Xero community. .

AccountingDepartment

AUGUST 25, 2022

When many business leaders think of maximizing ROI, they immediately think of reducing client acquisition costs and tightening spending controls. While these strategies are wise starting points, most businesses do not immediately consider outsourced accounting services as a way to get there. But, that is changing.

Speaker: Jamie Eagan

As organizations strive for agility and efficiency, it's imperative for finance leaders to embrace innovative technologies and redefine traditional processes. Join us as we explore the pivotal role of digitalization and automation in reshaping what is commonly referred to as the “last mile of reporting”. We’ll deep-dive into why digitalization is no longer a choice, but a necessity for finance departments to stay competitive in a fast-paced environment touching on: 2024 trends for the Office of

Xero

AUGUST 25, 2022

The last two days at Xerocon New Orleans have been a fantastic whirlwind, and I was particularly thrilled to speak about my favourite topic – how to keep your practice cyber safe – in a breakout session on the second day for our delegates. . As Xero’s General Manager for Security Assurance, this is a topic very close to my heart, and it’s this education and awareness piece that makes up a huge part of the work my team and I do on a day-to-day basis. .

Withum

AUGUST 25, 2022

The Federal Work Opportunity Tax Credit (“WOTC”) provides tax incentives for hiring individuals who traditionally face barriers to employment. Unlike many state incentives, WOTC is available to restaurant and hospitality businesses. Furthermore, WOTC does not require employers to increase their overall headcount – merely replacing a departing employee with a WOTC-eligible employee is eligible – so the “churn” counts for generating tax credits.

Xero

AUGUST 25, 2022

Today, we wrapped up Xerocon New Orleans, the second of three Xerocon events we’re hosting in 2022. . Despite its name, Xerocon isn’t just about Xero – it’s really about our partners and community. It’s so important that we connect with our communities to understand why they choose Xero, what is working well, and where we can improve. After being unable to connect in person at Xerocon for nearly three years, this connection felt especially important and special this year. .

Going Concern

AUGUST 25, 2022

Wesley Freeman with his wife, Alicia. The Atlanta Journal-Constitution reported today that a GoFundMe campaign has been started for the family of Wesley Freeman, the BDO Atlanta managing director who was shot and killed by his former BDO colleague Raissa Kengne on Aug. 22. Here is a Facebook post from Beth Lee Garner, national practice leader of employee benefit plan audits for BDO USA, who worked with Freeman for 15 years at the firm ’s Atlanta office: The GoFundMe , organized by family friend

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

Patriot Software

AUGUST 25, 2022

As a busy business owner, you’re always looking for ways to save your time and money. And, you certainly don’t want to waste your precious time, energy, and hard-earned cash on accounting tasks. The solution? Accounting software. Along with saving your money and time, there are plenty of other advantages of accounting software. Ready to […] READ MORE.

Going Concern

AUGUST 25, 2022

Here’s one for you. The city of Palo Alto, CA is looking for a new city auditor after its last one, Kyle O’Rourke, resigned from his role at Baker Tilly on August 15. MP Vicki Hellenbrand informed the city about the resignation two days later. O’Rourke, a principal at the firm, has been serving the city since 2020 when the city council eliminated all positions in the city auditor’s office and decided to outsource the work to an outside firm (BT).

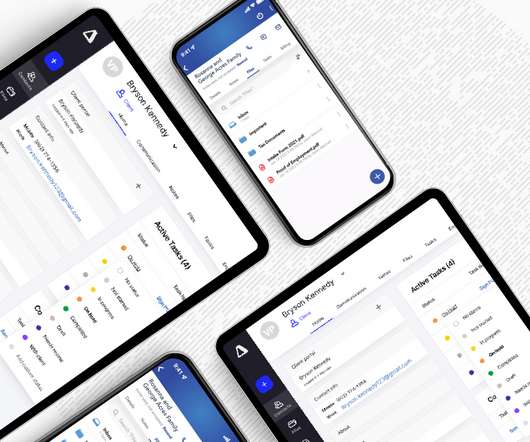

Canopy Accounting

AUGUST 25, 2022

How can accountants leverage practice management software to be more efficient? Three things. One, they can learn what accounting practice management software is and what it’s capable of doing. And two, they can start using it.

Going Concern

AUGUST 25, 2022

Plenty of new promotion purple roses were handed out at Grant Thornton on Aug. 1, as the firm celebrated its largest class of new partners, principals, and managing directors in GT ’s history. The 96 new PPMDs in the class of 2022 surpasses the 87 in last year ’s class, which had been Grant Thornton’s largest ever. But the group of 38 new partners and principals is lower than last year’s group of 46.

Advertiser: Paycor

Blue-collar jobs have a branding problem. One company, GEON, partnered with Paycor to find the solution. Learn how to attract, engage, and retain blue-collar employees, helping them build meaningful careers – and support your company’s goals.

ThomsonReuters

AUGUST 25, 2022

Requirements Related to Surprise Billing: Final Rules, 26 CFR Part 54; 29 CFR Parts 2510 and 2590; 45 CFR Part 149, 87 Fed. Reg. __ (Aug. 26, 2022); DOL Fact Sheet: Requirements Related to Surprise Billing: Final Rules (Aug. 19, 2022). Regulations. Fact Sheet. The DOL, HHS, and IRS have finalized portions of the surprise medical billing regulations covering the independent dispute resolution (IDR) process.

Going Concern

AUGUST 25, 2022

A tipster has directed us to some news coming out of the Netherlands this week that otherwise would have flown under our radar so thanks for that, tipster. The tip: 1200 Scandinavian employees of EY partying in a beach hotel in the Netherlands. OK that sounds tame enough, how much trouble can 1200 EYers cause? Let’s see the news story. Oh. Yeah that’s a lot.

KROST

AUGUST 25, 2022

LOS ANGELES, CA — Los Angeles-based CPA firm, KROST CPAs & Consultants, appoints Matthew Weber, CPA, MAcc, and Jonathan Louie, CPA, MST, to join KROST’s Principal in Development (PID) program. In the PID program, Matthew and Jonathan will join leadership trainings to prepare for the partner path, as well as attend partner meetings to gain Read the full article.

Inform Accounting

AUGUST 25, 2022

HMRC has published the latest advisory fuel rates (AFR) for company car users, effective from 1 September 2022, increasing rates between one and two pence per mile. The advisory fuel rates that apply from 1 September 2022 have been increased for some classes of vehicles from the June 2022 rates with a one pence increase on petrol vehicles under 2000cc and two pence for vehicles over 2000cc.

Advertisement

Technology evolves at lightning speed, and as finance keeps changing, instant payments emerge as a game-changer for small businesses. By 2030, instant payments are projected to surge by 289% and will become the new norm in financial transactions. Our whitepaper reveals seven must-know facts about instant payments, offering to help you navigate this financial revolution effectively.

Intuitive Accountant

AUGUST 25, 2022

Small Business Insights program shows that real sales growth for US small businesses slowed to just 2.8% year-over-year two years after pandemic-induced recession.

Accounting Web

AUGUST 25, 2022

Accounting Software News Is Xero Really All That Different?

Advertisement

"Offer payroll and do it yourself,” they said. “It’ll be fun!” Spoiler alert: It was not fun. Most CPA firms know that they need to offer payroll services to their clients or risk losing them to another firm that will. However, many don’t really want to. It is often time-consuming and complex due to changing tax laws and regulations, and with the growing staffing shortages, most just don’t have the resources.

Let's personalize your content