ADP® Introduces New Resource Center to Empower Accountants

Insightful Accountant

JUNE 9, 2025

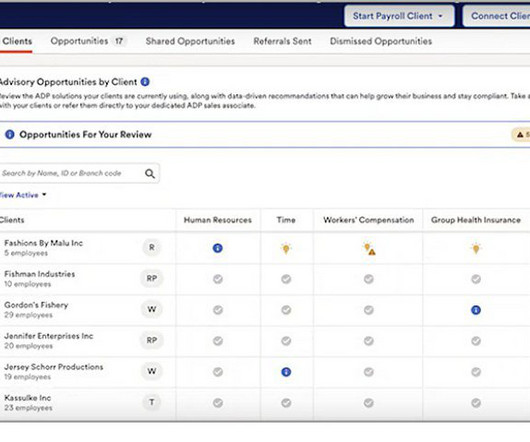

ADP®, a leading global technology company providing human capital management (HCM) solutions, has announced the launch of the Accountant Connect Resource Center, a centralized destination designed to help accounting professionals.

Let's personalize your content