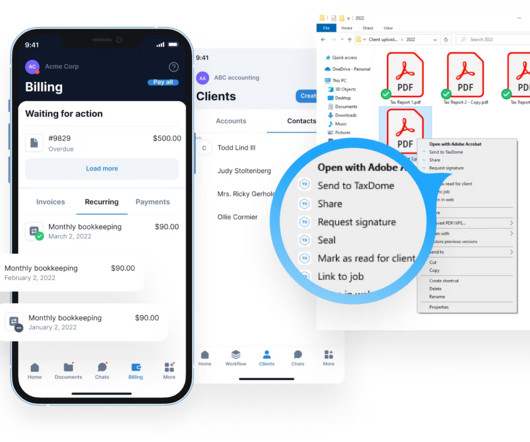

13 Best Document Management Software for Accounting Firms

Ryan Lazanis

APRIL 25, 2025

Tired of chasing down client documents? Here are 13 document management tools built to save time, reduce errors, and secure your firms data. The post 13 Best Document Management Software for Accounting Firms appeared first on Future Firm.

Let's personalize your content