Capital vs. control: PE's impact on CPA firms

Accounting Today

DECEMBER 5, 2024

Accounting firms see private-equity funding as a welcome resource for further expansion, but many professionals wonder what the true cost of the money is.

Accounting Today

DECEMBER 5, 2024

Accounting firms see private-equity funding as a welcome resource for further expansion, but many professionals wonder what the true cost of the money is.

TaxConnex

DECEMBER 5, 2024

The explosion of online holiday shopping in and around Thanksgiving has evolved beyond conversational. It’s now expected – and getting bigger every year. Online retail ruled Black Friday , Nov. 29, this year, even as in-person shopping dropped slightly. Adobe Analytics reported $10.8 billion in U.S. online sales on Black Friday, up 10.2% over last year – a record amount of spending on that day of the calendar.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

CPA Practice

DECEMBER 5, 2024

Following the November presidential election, CPA business leaders have a much more positive outlook about the U.S. economy and their own organizations for the next 12 months, according to the fourth-quarter AICPA & CIMA Economic Outlook Survey. The quarterly survey includes 273 qualified responses from CPAs and Chartered Global Management Accountants (CGMAs) who hold leadership positions, such as CFO or controller, in their companies.

Going Concern

DECEMBER 5, 2024

Are you having trouble finding remote accountants, CAS experts, auditors, or tax professionals for your firm or internal team? Accountingfly can assist you! With our Always-On Recruiting service, you can access a pool of top remote accounting candidates without any upfront costs. Sign up now to view the complete candidate list and connect with potential hires.

Speaker: Joe Wroblewski, Sales Engineer Manager

Automating time-consuming manual tasks can save your firm hundreds of hours–and thousands of dollars. But it can also have longer-lasting benefits, like helping you attract and retain the next generation of CPAs, and we don’t need to tell you how important that is amid the current generational staffing crisis in the tax and accounting profession. You'll want to save your seat for this new webinar with industry expert Joe Wroblewski, where we'll explore how to: Maximize ROI with Cost-Effective Te

CPA Practice

DECEMBER 5, 2024

Top 100 accounting firm Dean Dorton is expanding its specialized forensic accounting and valuation services for clients after bringing aboard Shilts CPA, a forensic accounting and valuation firm based in Jacksonville, FL, on Dec. 1. Financial terms of the deal weren’t disclosed. Josh Shilts, founder and CEO of Shilts CPA, is now a director in Dean Dorton’s Valuation and Forensic Services practice.

ThomsonReuters

DECEMBER 5, 2024

As a tax and accounting professional, you understand tax research and staying current with new developments can be time-consuming, especially in todays ever-changing legislative and regulatory environment. In fact, state legislatures have found that keeping pace with the changes and complexity of tax laws continues to be a top concern for most CPA firms.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

Accounting Today

DECEMBER 5, 2024

A federal district court has issued a preliminary injunction to prevent the government from enforcing the Corporate Transparency Act.

Withum

DECEMBER 5, 2024

In government contracting, understanding the various types of indirect cost rates used for pricing and billing is crucial. Why? By establishing indirect rates, contractors are equipped to calculate the total cost of contract performance. Additionally, federal contractors are also able to determine how much of their indirect costs (G&A, overhead, etc.) can be recovered.

Accounting Today

DECEMBER 5, 2024

Partnerships have ways to correct errors on the returns they've filed to avoid closer scrutiny.

Summit CPA

DECEMBER 5, 2024

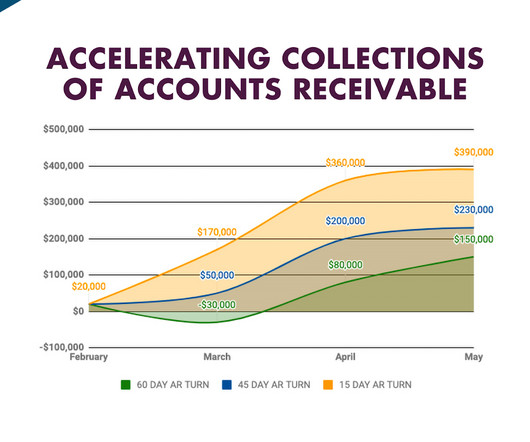

Is your service-based business experiencing inconsistent cash flow that is hard to forecast ? Your accounts receivable days might be to blame. Whether you don’t yet have payment terms or aren’t consistently following up on unpaid invoices, not receiving cash on time can cause unwanted side effects.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Accounting Today

DECEMBER 5, 2024

But last weekend was just the beginning: Retailers need help for the rest of the year, too.

Withum

DECEMBER 5, 2024

See What’s New For 2025 With 2024 coming to a close, the IRS recently released updated numbers for 2025 benefit plan limits. Download our 2025 Benefit Plan Limits and Thresholds guide for updated information on: 401(K) Plans Defined Benefit Plans Health & Welfare Plans Form 5500, 990, LM-2, W-2, and 1099 Filing Deadlines Download Guide Contact Us Learn how Withum can help.

Accounting Today

DECEMBER 5, 2024

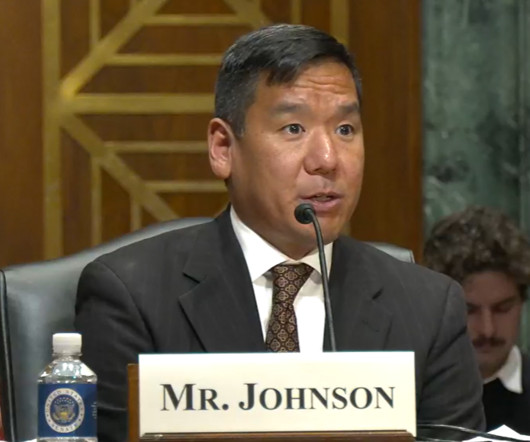

The Senate Finance Committee voted along party lines to approve the nomination of David Samuel Johnson as the next Treasury Inspector General for Tax Administration.

AccountingDepartment

DECEMBER 5, 2024

In 2025, small and medium-sized businesses (SMBs) face a rapidly changing economic landscape. From navigating inflation and supply chain disruptions to adopting new technologies and meeting rising customer expectations, business owners have a lot on their plates.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

Accounting Today

DECEMBER 5, 2024

The Public Company Accounting Oversight Board is also offering insights on improving audit committee communications and a video on the new confirmation standard.

Withum

DECEMBER 5, 2024

There are various types of tax professionals who practice in the M&A space. An obvious one is a tax lawyer who can weave both tax and non-tax issues together to produce a tax-efficient transaction. That skill, no doubt, is invaluable, in as much as weaving together even a couple provisions, let alone scores, of the Code, is daunting, and incurring a large tax bill can dampen the appeal of selling a business.

ThomsonReuters

DECEMBER 5, 2024

← Blog home At Thomson Reuters, we’re known for our trusted AI, advanced technology, and deep expertise across legal, tax, and compliance. But we don’t stop there. Through our Partnerships & Alliances Program , we have built a thriving ecosystem of world-class partnerships, offering professionals like you a unique opportunity to harness our mutual strengths, capabilities, and resources to better navigate today’s complex landscape.

Accounting Today

DECEMBER 5, 2024

It's in your best interest to help your clients receive their payments faster and reevaluate spending.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

IgniteSpot

DECEMBER 5, 2024

As a business owner, its easy to focus on growth and the hustle. But if youre finding that your businesss cash balance is smaller than youd like, it might not just be the economyit could be your spending habits. Lets dive into why your business is struggling to save money and, more importantly, what you can do about it right now.

Accounting Today

DECEMBER 5, 2024

The Electronic Tax Administration Advisory Committee is a forum for issues in electronic tax administration, such as ID theft and refund fraud.

Ace Cloud Hosting

DECEMBER 5, 2024

Accounting compliance is the legal framework created by regulatory bodies that business firms must follow by the ordinances, regulations, and ethics of reporting and bookkeeping. In the United States, companies.

Accounting Today

DECEMBER 5, 2024

Brace yourself; more Ultimate crimes; good enough; and other highlights of recent tax cases.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

CPA Practice

DECEMBER 5, 2024

Tipalti has announced the launch of its localized solution for the Canadian market and registration as a money services business (MSB) with the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC), marking a significant milestone in its international expansion. Since establishing a presence in Canada with its Vancouver office in 2020 and its Toronto office in 2022to support its US headquarters, Tipalti has grown its Canadian workforce to over 300 employees and serves more than

Withum

DECEMBER 5, 2024

Microsoft has pushed Copilot Agents to the Business Chat areas of Copilot (e.g., Teams Chat and Office.com). This feature enables every Copilot license holder to create personalized agents, making Copilot even more adaptable to individual requirements. These agents can be shared within an organization, fostering collaboration and enhancing productivity.

Accounting Today

DECEMBER 5, 2024

As you plan for 2025 and beyond, attack your strategic plan in a more open, creative way than in the past.

CPA Practice

DECEMBER 5, 2024

Payroll Integrations , the technology company that’s reimagining how employers support employees’ financial well-being through benefit automation, has announced its work with U.S. employers to expedite their compliance with the SECURE 2.0 Act. The company’s platform prepares companies for compliance with the new 2025 requirements under SECURE 2.0, including auto-enrollment in new retirement plans.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Insightful Accountant

DECEMBER 5, 2024

The challenge of workplace loneliness hits particularly hard in tax practices, where remote work and intense seasonal pressures can strain team connections.

FraudFiles

DECEMBER 5, 2024

Trust is inherent in any good business. We continuously place trust in our employees and in those with whom we do business. But that trust which is so necessary to the operation of a business is also the impetus for thieves to profit. It is unfortunate that fraud occurs when and where you least expect [.

Accounting Today

DECEMBER 5, 2024

Bequests returning territorial assets to indigenous nations pose thorny questions for financial advisors and their clients, two experts tell FP.

Menzies

DECEMBER 5, 2024

Menzies LLP - A leading chartered accountancy firm. It can be concerning when a company that owes you money is placed into Administration. But receiving a proposal explaining that a pre-packaged sale of the customer’s business has taken place raises the question; should they continue trading with the new entity? Trade creditors usually find out that a customer has entered into Administration upon receiving a letter and set of proposals.

Advertiser: Paycor

Great leadership development is the key to sustainable business growth. Are you ready to design an effective program? HR can use Paycor’s framework to: Set achievable goals. Align employee and company needs. Support different learning styles. Empower the next generation of leaders. Invest in your company’s future with a strong leadership development program.

Let's personalize your content