Report Shows Firms That Embrace AI Have Competitive Advantage

CPA Practice

FEBRUARY 20, 2025

The report reveals that mid-sized (21-50 employees) and large firms (over 200 employees) are leading AI adoption.

CPA Practice

FEBRUARY 20, 2025

The report reveals that mid-sized (21-50 employees) and large firms (over 200 employees) are leading AI adoption.

Reckon

FEBRUARY 20, 2025

The deadline for the new tax reporting requirements for Not For Profit (NFP) organisations with an active ABN is set for 31st March 2025. However, the new reporting scheme has left some NFPs uncertain of their status or tax obligations. Announced in 2021, the Australian government imposed the new self-reporting requirements to ensure that only eligible NFPs can access income tax exemption.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

CPA Practice

FEBRUARY 20, 2025

To avoid mistakes and potential processing delays, taxpayers should refrain from filing until they have received all necessarytax documents. Taxpayers should always carefully review documents for inaccuracies or missing information.

Accounting Today

FEBRUARY 20, 2025

The threatened layoffs of Internal Revenue Service employees appeared to be underway Thursday, with estimates of between 6,000 and 7,000 employees being laid off at the agency in the middle of tax-filing season.

Speaker: Joe Wroblewski, Sales Engineer Manager

Automating time-consuming manual tasks can save your firm hundreds of hours–and thousands of dollars. But it can also have longer-lasting benefits, like helping you attract and retain the next generation of CPAs, and we don’t need to tell you how important that is amid the current generational staffing crisis in the tax and accounting profession. You'll want to save your seat for this new webinar with industry expert Joe Wroblewski, where we'll explore how to: Maximize ROI with Cost-Effective Te

CPA Practice

FEBRUARY 20, 2025

The federal cost-cutting effort dubbed the Department of Government Efficiency says it has saved $55 billion in federal spending so far, but its website only accounts for $16.6 billion of that.

Accounting Today

FEBRUARY 20, 2025

AI can help reduce a company's environmental impact through data-driven analytics and optimization, though the energy burden of AI itself remains a challenge.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

Accounting Today

FEBRUARY 20, 2025

Members of the Tennessee Society of CPAs visited the state capital in Nashville this week to lobby for changes in the licensure and mobility laws.

Ryan Lazanis

FEBRUARY 20, 2025

Save time and effort with accounts receivable automation - the powerful solution to automate a manual accounting process. Learn more here! The post Accounts Receivable Automation: The Complete Guide appeared first on Future Firm.

Accounting Today

FEBRUARY 20, 2025

Major changes are afoot for companies that want to claim the research tax credit.

CPA Practice

FEBRUARY 20, 2025

In their latest video and podcast, Randy Johnston and Brian Tankersley, CPA, review ZOHO in their roundup of AI systems for accounting firms.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Accounting Today

FEBRUARY 20, 2025

The cloud is safe, yes but it doesn't protect your and your clients' data from every possible threat.

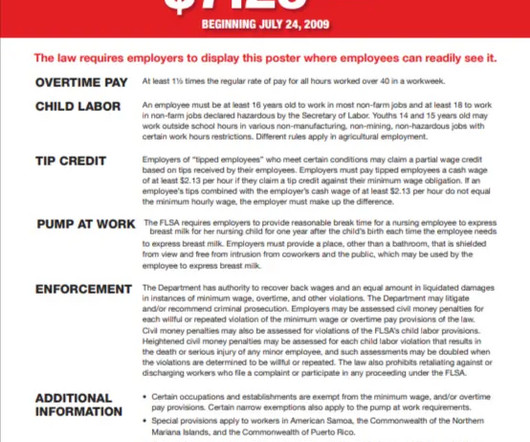

Patriot Software

FEBRUARY 20, 2025

Do you really know what minimum wage posters you have to display around your office? Many employers dont, and that can lead to penalties. If youre even slightly unsure, read on. Failing to post required federal, state, and local posters isnt just a minor oversightit could cost you.

AccountingDepartment

FEBRUARY 20, 2025

In the fast-paced world of entrepreneurship and business management, the importance of maintaining impeccable financial records cannot be overstated. Accounting and controller services are the backbone of a well-oiled business machine, guiding entrepreneurs toward clarity and strategic growth.

Accounting Today

FEBRUARY 20, 2025

Hiring and salaries grew more quickly for accountants than any other job group last year, according to a new report.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

CPA Practice

FEBRUARY 20, 2025

Lili, a financial platform designed for small business owners, today announced the launch of international wire payments in 27 countries, empowering small business owners to grow beyond borders.

Accounting Today

FEBRUARY 20, 2025

Fell a little short; oh brother; only one hitch; and other highlights of recent tax cases.

Xero

FEBRUARY 20, 2025

As a Xero partner, youre always looking for ways to help boost your efficiency and better serve your clients. Thats where Ignite comes in our new Xero plan which streamlines the old GST Cashbook and Starter plans. Discover the benefits and pricing of Ignite and see how its already helping partners and their clients across Australia and New Zealand improve insight into their cash flow.

Accounting Today

FEBRUARY 20, 2025

As the digital asset landscape becomes increasingly unpredictable, it's important to encourage clients to diversify their holdings across sectors and types.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

Insightful Accountant

FEBRUARY 20, 2025

Intuit will offer a free V-con March 25-27 to prepare ProAdvisors for 'Level 2' Certification.

Ace Cloud Hosting

FEBRUARY 20, 2025

Accounting is a crucial yet challenging function for any small business. Managing finances requires accuracy, security, and efficiency. Using accounting software can enhance accuracy, ensure data security, and streamline financial.

Insightful Accountant

FEBRUARY 20, 2025

Some mechanisms implemented to deal with 2025 application problems could result in surprises for many ProAdvisors who were otherwise 'disappointed' in their application process experience.

Inform Accounting

FEBRUARY 20, 2025

Planning for the cost of business motoring is always important. We look here at the change to the tax treatment of double cab pick-ups (DCPUS) announced in the Autumn Budget 2024, and suggest how tax incentives for low emission technology can continue to help employers.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Insightful Accountant

FEBRUARY 20, 2025

In this insightful episode, host Gary DeHart sits down with HR expert Michelle LeBlanc to explore key HR strategies for accountants and professionals in regulated industries like finance, healthcare, and energy.

RogerRossmeisl

FEBRUARY 20, 2025

In a major development for U.S. businesses, the Financial Crimes Enforcement Network (FinCEN) has announced the reinstatement of the beneficial ownership information (BOI) reporting mandate under the Corporate Transparency Act (CTA). The decision comes on the heels of a February 18, 2025, ruling by the U.S. District Court for the Eastern District of Texas, which lifted a preliminary injunction in the case of Smith, et al. v.

TaxConnex

FEBRUARY 20, 2025

Getting the right sales tax on your invoice is a pivotal step in managing your sales and use tax obligation. With cities, counties and states having their own tax rates, taxability rules changing among states and even local jurisdictions, it is almost impossible to ensure you add the correct sales tax to your invoice for a more complex organization.

Withum

FEBRUARY 20, 2025

Stay up-to-date with the latest BOI reporting requirements and how recent legal changes may affect your business. Subscribe to our Business Tax insights for timely updates delivered directly to your inbox. February 20, 2025 Yes, Its True, Beneficial Ownership Information Reporting Is Back On In a plot twist worthy of daytime television, beneficial ownership information (BOI) reporting under the Corporate Transparency Act (CTA) has made a dramatic comeback.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

CPA Practice

FEBRUARY 20, 2025

A technical glitch prevented officials from notifying thousands of IRS employees via email that they were being terminated. The agency had to resort to paper.

ThomsonReuters

FEBRUARY 20, 2025

Jump to Overview of the Corporate Transparency Act Corporate Transparency Act timeline of events Current status of the CTA and important facts for LLC owners Steps for small businesses to file a Beneficial Ownership Information Report (BOIR) Implications for tax and accounting professionals Ensuring Corporate Transparency Act compliance and supporting your clients Catch up with the Corporate Transparency Act below More on the Corporate Transparency Act Are you ready?

CPA Practice

FEBRUARY 20, 2025

This article includes an easy reference chart that taxpayers can use to estimate how soon they may get their income tax refund.

Withum

FEBRUARY 20, 2025

The deadline for submitting the San Francisco Gross Receipts Tax return is quickly approaching on February 28, 2025. Before calculating the first quarterly payments for 2025, consider the changes enacted by voters in 2024 as part of Proposition M. A broad restructuring of the exemption threshold, apportionment formulas, and rates could considerably change your tax liability and estimates required for 2025.

Advertiser: Paycor

Great leadership development is the key to sustainable business growth. Are you ready to design an effective program? HR can use Paycor’s framework to: Set achievable goals. Align employee and company needs. Support different learning styles. Empower the next generation of leaders. Invest in your company’s future with a strong leadership development program.

Let's personalize your content