Tax season 2025 so far: By the numbers

Accounting Today

MARCH 24, 2025

With tax season underway, here are the filing statistics, updated weekly.

Accounting Today

MARCH 24, 2025

With tax season underway, here are the filing statistics, updated weekly.

CTP

MARCH 24, 2025

The Tax Cuts and Jobs Act (TCJA) brought about far-reaching changes in the world of tax law. Though recent conversations have fixated on the soon-to-expire tax provisions, TCJA also introduced permanent changes that tax professionals can lean on to bring tax savings to their clients. One significant benefit to small business owners was the introduction of new rules surrounding the cash method of accounting.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Withum

MARCH 24, 2025

If the development of a real estate property is executed without any complications, the project will begin operations and be placed in service post-production. However, what if unexpected situations delay construction? There may not be material costs, but if a project is funded with loans, interest will continue to accrue. This article takes a closer look at the tax treatment of interest expense during prolonged real estate development.

CTP

MARCH 24, 2025

When you hear about the Tax Cuts and Jobs Act (TCJA), typically people are speculating about the future of the tax laws that expire this year. What we hear less about are the tax provisions that were made permanentand that could be beneficial to your business. For instance, when you established your business, you selected a method of accounting. If you have a C corporation or a larger business, that decision may have been made for you, since most of these entities are required to use the accrual

Speaker: Joe Wroblewski, Sales Engineer Manager

Automating time-consuming manual tasks can save your firm hundreds of hours–and thousands of dollars. But it can also have longer-lasting benefits, like helping you attract and retain the next generation of CPAs, and we don’t need to tell you how important that is amid the current generational staffing crisis in the tax and accounting profession. You'll want to save your seat for this new webinar with industry expert Joe Wroblewski, where we'll explore how to: Maximize ROI with Cost-Effective Te

Accounting Today

MARCH 24, 2025

The interim final rule removes the requirement under the Corporate Transparency Act for U.S. companies and people to report beneficial ownership information.

CPA Practice

MARCH 24, 2025

The Public Company Accounting Oversight Board has released a series of three staff presentation videos focused on implementing the monitoring and remediation process under QC 1000,A Firms System of Quality Control.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

CPA Practice

MARCH 24, 2025

The US LEI fell again in February and continues to point to headwinds ahead, said the Conference Board senior manager.

Accounting Today

MARCH 24, 2025

The Public Company Accounting Oversight Board has created three videos from its staff on its quality control standard's monitoring and remediation process.

CPA Practice

MARCH 24, 2025

CRM technology, cloud ERP, and analytics and business intelligence (ABI) tools were the top three most valued technologies in the finance function

Accounting Today

MARCH 24, 2025

All too often, what accountants are selling are services that clients have to endure, says Joe Woodard, not the sort of thing that they really value.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

CPA Practice

MARCH 24, 2025

While concerns about data accuracy, security, and privacy persist, survey responses from 500+ business owners and 500+ HR leaders found that the business impact of AI is undeniable 72% of small businesses have a positive outlook on the technology.

Accounting Today

MARCH 24, 2025

GASB released a study on utilization of GAAP among state and local governments and found all the states are using GAAP, but only about three-quarters of localities are.

CPA Practice

MARCH 24, 2025

The event also featured a panel discussion of C-suite thought leaders, including attorneys and tax advisors, who shared their organizations approach to generative AI tools and applications.

Accounting Today

MARCH 24, 2025

ERP solutions provider Acumatica announced the rollout of its R1 release, sporting enhanced AI features as well as more industry-specific solutions.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

CPA Practice

MARCH 24, 2025

A wealth tax could bring states a lot of revenue. But voters dont like it, even though few of them would have to pay.

Accounting Today

MARCH 24, 2025

When small CPA shops suddenly end, clients are left to scramble for a replacement and any enterprise value that the owner may have had withers away.

CPA Practice

MARCH 24, 2025

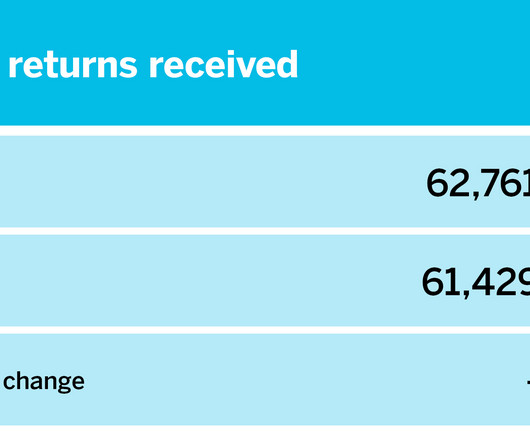

The number of tax returns that have been filed with the IRS is down 1.7% compared to this time last year, but the average tax refund amount is up 5.2%, according to the agency's latest 2025 tax season data.

Insightful Accountant

MARCH 24, 2025

The IRS's recent return-to-office mandate has created significant operational disruptions that may impact tax practitioners' interactions with the agency. Understanding these changes can help tax practice managers better navigate.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

Ace Cloud Hosting

MARCH 24, 2025

Tax and accounting firms handle a wealth of sensitive client data, making compliance with privacy laws a legal necessity and a critical aspect of maintaining trust and reputation. If youre.

Insightful Accountant

MARCH 24, 2025

If you haven't voted for the 2025 ProAdvisor Awards now is the time to cast your ballot for this year's candidates for both U.S. and International award candidates. Voting ends April 1, so don't miss this opportunity to vote for the awards.

Inform Accounting

MARCH 24, 2025

Benefits in kind (BIK) are goods and services provided to an employee (or a member of their family or household) for free or at significantly reduced cost. The type of benefit and the way it is provided can affect the tax and NICs to be paid and the reporting requirements.

Insightful Accountant

MARCH 24, 2025

While this is our third trip (of the imagination) for this year, but the first of my 'battlefield' explorations. We will spend the night in Washington, DC and then take a day-long tour of Gettysburg, followed by a tour of Manassas Battlefield Park.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Wellers Accounting

MARCH 24, 2025

Simon Smith bids farewell to Stuart Crook who is leaving Wellers at the end of March 2025 after 25 years at the firm.

RogerRossmeisl

MARCH 24, 2025

On March 21, 2025, the IRS released updated FAQs and guidance that introduce a new process for taxpayers dealing with Employee Retention Tax Credit (ERTC) refunds, particularly when those refunds relate to wages paid in prior tax years like 2020 or 2021. This update aims to simplify reporting requirements and provide clarity for taxpayers who either received ERTC refunds or had their claims disallowed.

Accounting Today

MARCH 24, 2025

The Internal Revenue Service is reportedly getting close to an agreement to share information such as taxpayers' addresses with ICE officials upon request.

CPA Practice

MARCH 24, 2025

As theSocial Security Administration prepares tomake major changesin how beneficiaries prove their identity, the AARP is iasking the agency to reconsider the plan.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Withum

MARCH 24, 2025

DIY, Do-It-Yourself. Staples has the Easy button. Home Depot advertises everything you need for do-it-yourself home improvement projects. The HGTV and DIY networks have several shows dedicated to doing things yourself. Just a Google search on DIY returns links to people showing you how to make crafts, build your own computer, etc. However, when it comes to digital forensics, there isnt an easy button or find all evidence button.

CPA Practice

MARCH 24, 2025

The interim final rule issued by the Financial Crimes Enforcement Network on March 21 marks the end of an on-again, off-again saga for thousands of small businesses that began in late 2024.

Accounting Seed

MARCH 24, 2025

A business manager reviews her quarterly product performance report. The data shows that Product A is generating higher margins than Product B. Based on this information, she redirects marketing resources, adjusts purchasing plans, and reallocates staff. Six months later, she realizes someone had been incorrectly categorizing certain costs between the product lines.

Withum

MARCH 24, 2025

Hospitality businesses are complex. They often operate in moving parts with large staffs and multiple integrated technologies and systems. AI in the hospitality industry is expected by many to incite a revolution that forces traditional, inefficient practices to be replaced by newer, more efficient ways of doing things. This could be as simple as chatbots that handle hotel guest communications 24/7.

Advertiser: Paycor

Great leadership development is the key to sustainable business growth. Are you ready to design an effective program? HR can use Paycor’s framework to: Set achievable goals. Align employee and company needs. Support different learning styles. Empower the next generation of leaders. Invest in your company’s future with a strong leadership development program.

Let's personalize your content