Do we need accounting firms?

Accounting Today

AUGUST 26, 2022

RogerRossmeisl

AUGUST 28, 2022

Sometimes, bigger isn’t better: Your small- or medium-sized business may be eligible for some tax breaks that aren’t available to larger businesses. Here are some examples. QBI deduction For 2018 through 2025, the qualified business income (QBI) deduction is available to eligible individuals, trusts and estates. But it’s not available to C corporations or their shareholders.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Simple Accounts

AUGUST 19, 2022

You might have heard the term ‘Bank reconciliation’ multiple times but did not bother to go in-depth to find out what it is. If you are someone who is in the business game or who is interested in such details, you might know this. Let us see what it is and how it helps in your business in the simplest way. . Bank Reconciliation: Definition . Bank reconciliation is the process of identifying, comparing, and matching your financial records and bank statements.

Advertisement

The office of the CFO is rapidly evolving, with more and more demands being placed upon the finance and accounting team each year. Join us in this webinar, where we share 8 things to NOT do when it comes to helping the CFO office advance in supporting the business. Learning Objectives: This course objective is to understand how best to support an organization's finance leadership.

TaxConnex

AUGUST 11, 2022

A few recent developments – including scams and fine definitions –across the country show how sales tax compliance can be complicated. New York: An appeals court ruled last month against a company that claimed eligibility for sales tax refunds on several purchases of concrete. The petitioner argued that its purchases of concrete were for a nontaxable service provided by the seller that would also provide the installation of capital improvements to real property, rather than a taxable delivery of

Lockstep

AUGUST 3, 2022

When you are just starting out, using email to manage the inflow of communications and documents to/from customers and vendors makes sense. You are building relationships and managing invoices with a personal touch. This might help you get paid a bit faster. With a manageable number of clients and vendors and a small team, basic accounting inbox tools are good way to collect and store correspondence and the exchange of invoices, payment receipts, etc. .

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

RogerRossmeisl

AUGUST 23, 2022

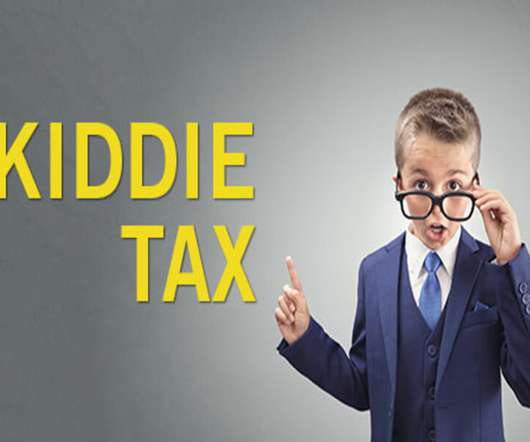

Many people wonder how they can save taxes by transferring assets into their children’s names. This tax strategy is called income shifting. It seeks to take income out of your higher tax bracket and place it in the lower tax brackets of your children. While some tax savings are available through this approach, the “kiddie tax” rules impose substantial limitations if: The child hasn’t reached age 18 before the close of the tax year, or The child’s earned income doesn’t exceed half of his or her s

Patriot Software

AUGUST 25, 2022

Do you daydream about working with family members? You may consider hiring your child if you’re a small business owner. That way, you can show them the ins and outs of your business and the importance of hard work. At the same time, you gain an extra set of hands to get tasks done (win-win-win!). […] READ MORE.

Canopy Accounting

AUGUST 15, 2022

Cloud computing is the process of delivering hosted services using the internet. In a short time, cloud computing has emerged as an efficient and advanced way to boost the success of just about every type of business. Accounting firms are not alone in harnessing this practice and many are seeing tremendous savings in time and money.

DuctTapeMarketing

AUGUST 10, 2022

10 Critical Elements Your Website Must Employ Today written by John Jantsch read more at Duct Tape Marketing. Many people assume that a website's purpose is to get new clients. Just create high-quality product pages, write a little content, add a CTA button then sit back and see if it works. Yet the primary goal of a website isn’t only to obtain new clients.

Speaker: Dylan Secrest, Founder of Alamo Innovation and Construction Digital Transformation Consultant

Construction payment workflows are notoriously complex when you consider juggling multiple stakeholders, compliance requirements, and evolving project scopes. Delays in approvals or misaligned data between budgets, lien waivers, and pay applications can grind progress to a halt. The good news? It doesn't have to be this way! Join expert Dylan Secrest to discover how leading contractors are turning payment chaos into clarity using digital workflows, integrated systems, and automation strategies.

TaxConnex

AUGUST 30, 2022

Many tech companies consider themselves a service provider exempt from sales and use tax. But the 2018 Wayfair decision expanded the definition of nexus and and more of these businesses are now subject to sales and use tax collection, including on one of their product staples: apps. A mobile application, or app, is a program or software application to run on a mobile device.

Acterys

AUGUST 12, 2022

Over the last 7 years, Power BI has developed into the predominant self-service analytics solution. It was b uilt for analyzing data, but the visualization and data modelling capabilities also make it the perfect platform for collecting data down to very sophisticated x P&A ( Extended Planning & Analytics) processes. The key arguments here are not just the unsurpassed visualization options that also enable dramatic improve ments for planning processes but also the ease of deployment and

RogerRossmeisl

AUGUST 23, 2022

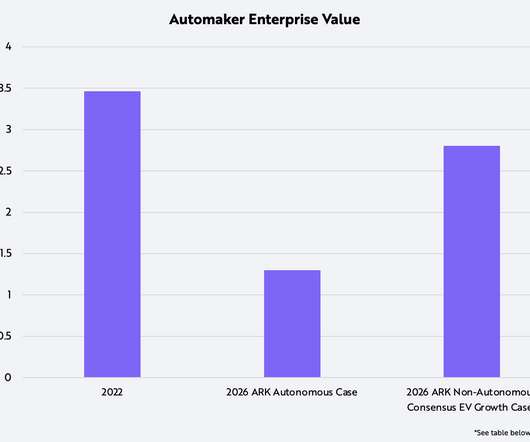

Excerpt of an article posted to the ARK Invest website on 7/15/22 According to the research of ARK Invest, during the next five years the auto industry as measured in units will grow, but as measured by enterprise value, it will shrink. In 2021, the number of light vehicles sold globally was 78 million and the enterprise value of automakers, roughly $3.5 trillion.

BurklandAssociates

AUGUST 23, 2022

Employee documentation can help your company raise that next round of funding and mitigate any allegations of unfair employment practices. The post Employee Documentation: Tips & Examples to Save Your Startup Money appeared first on Burkland.

Speaker: Gerald Ratigan

The accounts payable (AP) function is evolving and AI is leading the charge. As finance teams face rising invoice volumes and expectations for speed and accuracy, AI-powered automation has shifted from a futuristic concept to the most practical solution. But for finance leaders, success isn’t just about selecting the right tools, it’s about implementing the right strategy.

Accounting Web

AUGUST 16, 2022

Clients How to Simplify Communication With Clients.

TaxConnex

AUGUST 18, 2022

A lot of times regarding sales tax, the answer to any question is, “It depends.” This is another of those times. And then some. Covid created unique conditions for companies that must collect and remit sales tax, including many temporary breaks regarding worker locations. At the same time, the pandemic turned remote work from an occasional perk to a standard way of operating a company.

Withum

AUGUST 22, 2022

Many organizations have been surprised when they find that cyber insurance premiums have gone up and they now have less coverage. Some organizations are not able to renew their insurance pending proof of meeting the insurance company’s requirements that they have the controls needed to protect and defend themselves against cyberattacks. In another organization, a cyber insurance company denied their renewal because they could not clearly identify their cyber risk which the insurance company stat

Speaker: Sean Yoder

Nonprofits are under more pressure than ever to demonstrate financial accountability while continuing to expand their impact. Traditional budgeting models often fall short, reinforcing silos, limiting flexibility, and stalling growth. Enter collaborative budgeting: a dynamic, team-driven process that enables smarter resource allocation and builds financial resilience at scale.

RogerRossmeisl

AUGUST 28, 2022

When you take withdrawals from your traditional IRA, you probably know that they’re taxable. But there may be a penalty tax on early withdrawals depending on how old you are when you take them and what you do with the money. Important: Once you reach a certain age, you must start taking required minimum distributions from your traditional IRAs to avoid a different tax penalty.

BurklandAssociates

AUGUST 19, 2022

For more information, see HR Dive’s summary with links California California was the first state in the U.S. to legally require employers to provide the pay range for a job—if Read More. The post A Guide to States & Cities with Pay Transparency Laws in 2022 appeared first on Burkland.

Accounting Today

AUGUST 2, 2022

Acterys

AUGUST 25, 2022

This month, we are again releasing major improvements for Acterys. Our development team has been pretty busy working on significant functionality improvements and new features to make your experience with our products better in terms of speed, usability, security, and ease of use. We have added multiple new features, new Apps, upgraded Power BI visuals with refined functions, and enhanced overall application security.

Speaker: Joe Wroblewski, Sales Engineer Manager

Automating time-consuming manual tasks can save your firm hundreds of hours–and thousands of dollars. But it can also have longer-lasting benefits, like helping you attract and retain the next generation of CPAs, and we don’t need to tell you how important that is amid the current generational staffing crisis in the tax and accounting profession. You'll want to save your seat for this new webinar with industry expert Joe Wroblewski, where we'll explore how to: Maximize ROI with Cost-Effective Te

TaxConnex

AUGUST 16, 2022

Since the Wayfair decision four years ago, sales tax compliance has had to become a major priority for businesses with multistate sales. In fact, 24% of finance professionals rank one of their top concerns of managing sales tax as keeping up with their evolving nexus footprint, according to a TaxConnex blind survey conducted at the end of 2021. The survey also stated that over 10% of respondents still weren’t fully aware of the impact of Wayfair (economic nexus) on their business.

VetCPA

AUGUST 14, 2022

Do you like being in charge of your destiny and are you able to handle stress well? Do you have a great idea for a new business? You may be able to strike out on your own and become the entrepreneur you want to be. Here are some ideas that may help clarify your thinking and help you decide if you could become a successful entrepreneur. What’s Your Personality Type?

RogerRossmeisl

AUGUST 9, 2022

What happens if two or more individuals in your organization collude to commit fraud? According to the Association of Certified Fraud Examiners’ (ACFE’s) 2022 Report to the Nations, fraud losses rise precipitously. The median loss for a scheme involving just one perpetrator is $57,000, but when two or more perpetrators are involved, the median loss skyrockets to $145,000.

BurklandAssociates

AUGUST 16, 2022

Consider bringing on HR when you reach milestones like hiring your first out-of-state employees, adding benefits, and creating an employee handbook. The post When To Hire an HR Professional for Your Startup appeared first on Burkland.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

Acterys

AUGUST 12, 2022

Over the last 7 years, Power BI has developed into the predominant self-service analytics solution. It was b uilt for analyzing data, but the visualization and data modelling capabilities also make it the perfect platform for collecting data down to very sophisticated x P&A ( Extended Planning & Analytics) processes. The key arguments here are not just the unsurpassed visualization options that also enable dramatic improve ments for planning processes but also the ease of deployment and

TaxConnex

AUGUST 25, 2022

Consistent (i.e., “good”) service is a nice thing to have in any industry. In a field that changes as fast as sales tax, it’s a necessity. But providers have their own business priorities as well and if customer service isn’t at the top of their list, changes could end up harming you. Maybe they’ve priced themselves out of your range or discontinued the service you need, or have become too big to match your specific needs.

MyIRSRelief

AUGUST 1, 2022

According to the most up-to-date US Tax Code, all US-based business employers are required to file employment 941 / 940 Payroll Tax forms with the IRS every quarter and year-end at a prescribed date. These employment reporting forms goes along with all of the necessary payments that are made to the IRS throughout the year. When a Los Angeles, CA business employer runs afoul of the IRS, it is very important to know that it is serious and you should seek out professional help from a representation

Advertisement

You wouldn’t keep using a 2009 flip phone - so why settle for outdated close processes? It’s time for an upgrade. SkyStem's Guide to Month-End Close Software walks you through what today’s best tools can do (and what your team shouldn’t have to deal with anymore). Get smart, fast, and a whole lot less stressed when it’s time to close the books.

Let's personalize your content