Somehow Accounting Ended Up on This List of the Highest-Paying College Majors in 2022

Going Concern

DECEMBER 26, 2022

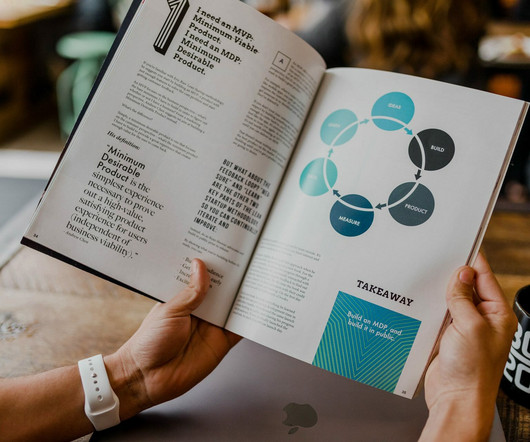

CBS News crunched some Payscale data and by some miracle, accounting ranked #52 on this list of the 60 highest-paying majors. Because we anticipate people might ask for proof of this, we have screenshotted accounting’s entry on said list. Text: Accounting isn’t just accounting anymore. Experts must perform multiple functions at once — and that’s where the accounting and computer systems major comes in.

Let's personalize your content