Getting Business Tax Returns in a Divorce

FraudFiles

JULY 5, 2023

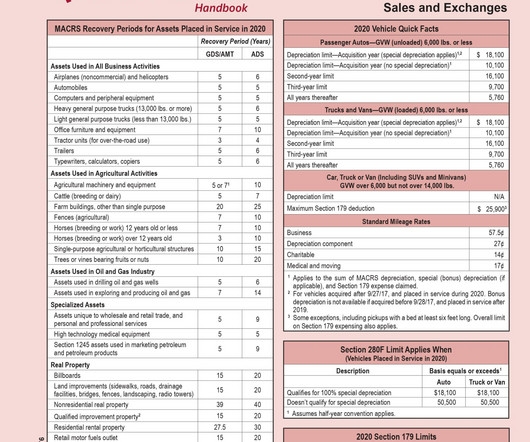

When one or both spouses have an ownership interest in a business, it is critical to get both income tax returns and financial statements for the entity. It is impossible to fairly evaluate the business and the income from it without both of these. Many times we meet resistance from …

Let's personalize your content