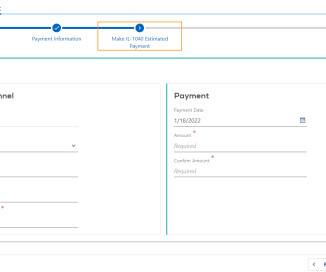

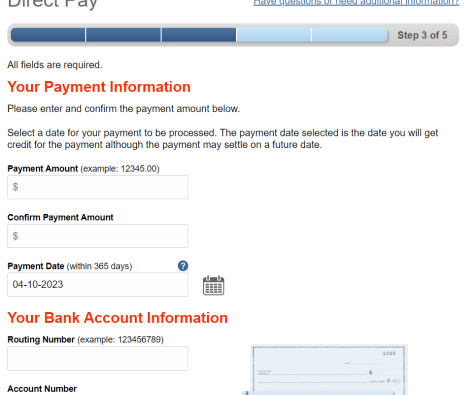

How To Make Quarterly Estimated Taxes Online — Illinois IDOR

Nancy McClelland, LLC

APRIL 9, 2023

Reminder: Due to a new law , Illinois S-Corp and Partnership owners should generally pay quarterly IL state ( not federal) taxes through the business. The post below is about how to pay IL taxes personally ; click here for how to make IL business tax payments. and ask you what kind of tax payment you wish to make.

Let's personalize your content