Los Angeles tax, accounting service

MyIRSRelief

DECEMBER 15, 2022

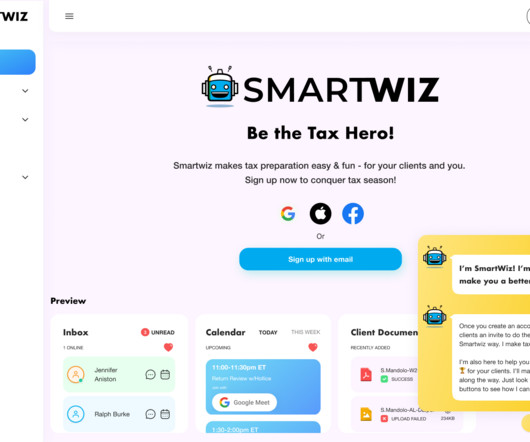

For example, you may want to catch up on your tax filings, prepare for an audit, or simply get a better understanding of your financial situation. This might include accounting software, a financial calculator, and reference materials such as tax guides or accounting textbooks.

Let's personalize your content