Why Hiring a Tax Pro Boosts Your Small Business (and Saves You Money)

MyIRSRelief

MAY 1, 2024

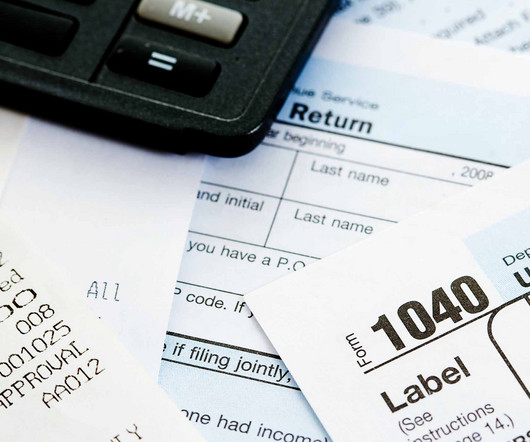

They stay current on the latest regulations, ensuring your business maximizes legal tax breaks on forms like 1120, 1120S, and 1065, while minimizing liabilities. Compliance Navigation: Tax compliance goes far beyond just filing. Time Efficiency: Tax preparation and research are notorious time-sinks.

Let's personalize your content