Four PPP Forgiveness Answers for S-Corp Owner-Employees

Bharmal&Associates

AUGUST 13, 2020

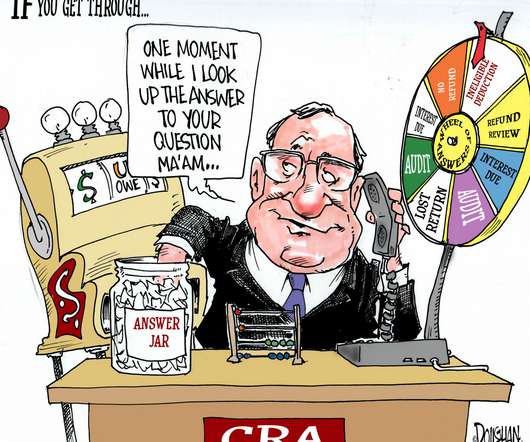

Tax law definitions do not apply to much of the Payroll Protection Program (PPP), making it new ground for owners of S corporations. a “non-owner employee” of the S corporation or. From what we know, you are a non-owner employee, which means you are not stuck with the owner-employee limits. My profit is my income.

Let's personalize your content