IRS Expands Business Tax Accounts to Include S Corporations and Partnerships

CPA Practice

DECEMBER 18, 2023

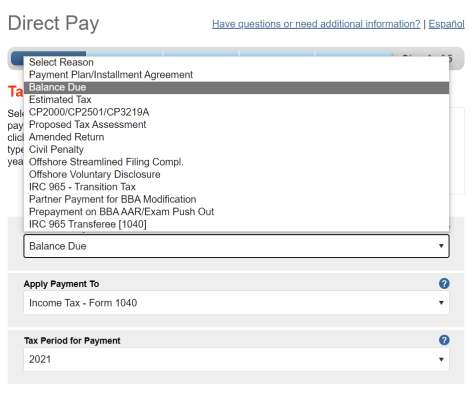

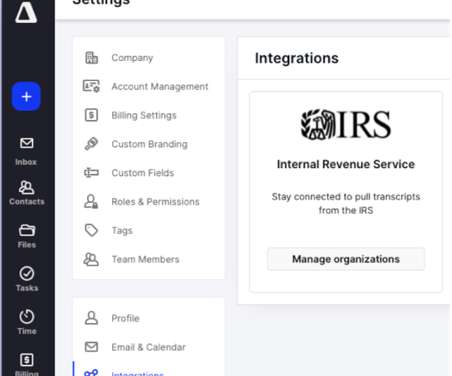

“This next step in the evolution of the Business Tax Account will help these businesses download transcripts and other features. Users can now download a PDF of a business tax transcript: For sole proprietors, this includes Forms: 940, 941, 943, 944, 945, 8752, 8288, 11-C, 730, 2290.

Let's personalize your content