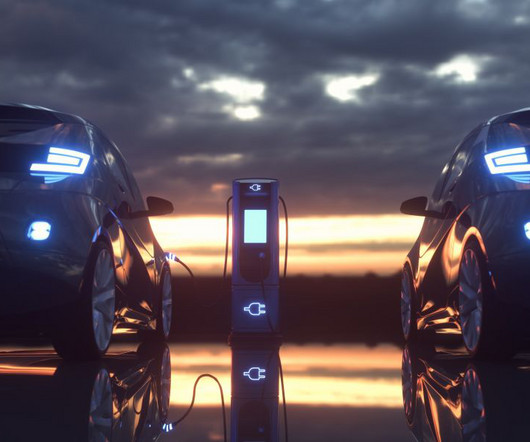

Treasury Has Issued Auto Dealers >$580 Million in Advance EV Tax Rebates This Year

RogerRossmeisl

APRIL 30, 2024

According to the Treasury, the US government has provided auto dealers with >$580 million in advance payments for consumer electric vehicle (EV) tax credits since 1/1/2024. Before 2024, American car purchasers were only eligible for the new electric vehicle (EV) credit of up to $7,500 or the $4,000 credit for used EVs when they submitted their tax returns in the subsequent year.

Let's personalize your content