IRS leveraging AI for audits amid layoffs

Accounting Today

MAY 27, 2025

The Internal Revenue Service is expected to lean more heavily on artificial intelligence technology to select cases as it carries out widespread layoffs.

Accounting Today

MAY 27, 2025

The Internal Revenue Service is expected to lean more heavily on artificial intelligence technology to select cases as it carries out widespread layoffs.

AccountingDepartment

MAY 29, 2025

Understanding exactly how much each job or project costs your business is essential for maximizing profitability. However, many business owners struggle to track costs accurately, leading to mispriced jobs and unexpected expenses later on. This is where job costing comes into play.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Going Concern

MAY 29, 2025

*In case it isn’t abundantly clear, she didn’t actually tell you to get CPA tattooed on your forehead as that would be ridiculous. Obviously. Susan S. Coffey, CPA, CGMA, CEOPublic Accounting at the Association of International Certified Professional Accountants has penned a little something for Journal of Accountancy worth our full attention.

CPA Practice

MAY 27, 2025

BDO began piloting potential tools and approaches in early 2023. Since then, BDO has achieved several business milestones in key commitment areas and seamlessly embedded AI in its operations and client service models.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Accounting Seed

MAY 28, 2025

This article was updated May 28, 2025. To be a successful government contractor, your business processes need to be Defense Contract Audit Agency (DCAA) compliant. Successfully completing a DCAA audit ensures the legality of your operation and helps you continue acquiring government contracts. You can make your life easier and guarantee smooth audits by using accounting software that helps government contractors meet DCAA compliance.

Accounting Today

MAY 29, 2025

BDO USA's CEO Wayne Berson will retire effective June 30, 2026, and national managing principal of tax Matthew Becker has been tapped to succeed him.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

Insightful Accountant

MAY 26, 2025

The tax landscape for pass-through entities is facing significant changes under the proposed "One Big Beautiful Bill" approved by Congress this week.

CPA Practice

MAY 29, 2025

Embedded Services aims to equip platform partners with capabilities that deepen customer engagement, drive loyalty, and unlock sustainable growth through enhanced user experiences.

Xero

MAY 27, 2025

The 2025 Xero US Roadshow is set to deliver a day packed with innovation, networking, and inspiration. Let’s explore what’s on the agenda and why you should care. Spotlighting Innovation: AI and Advisory Services The accounting industry isn’t what it used to be; it’s smarter, faster, and more efficient, thanks to AI and advisory services.

Accounting Today

MAY 29, 2025

Cutbacks and vague guidance threaten the IRS's ability to carry out its responsibilities, which include overseeing the troubled nonprofit hospital sector.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

Canopy Accounting

MAY 26, 2025

Keeping up with technologys evolution is easier said than done. However, when you future-proof your accounting firm's tech stack, you stay competitive while giving your team some breathing room. While classic spreadsheets will never go out of style, they require a lot of manual input and have difficulty keeping pace with your clients and employees needs.

Ryan Lazanis

MAY 26, 2025

Get your new bookkeeping clients up to speed fast. Use this free onboarding checklist to start strong and stay on track. The post The Only Bookkeeping Client Onboarding Checklist Youll Need appeared first on Future Firm.

CPA Practice

MAY 29, 2025

The Washington-based ERP provider said on May 29 it has signed an agreement to be acquired by Vista Equity Partners, the global investment firm that purchased Avalara in 2022.

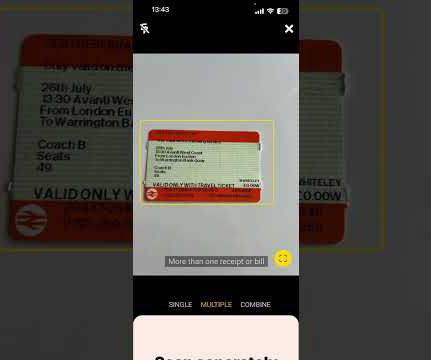

Xero

MAY 28, 2025

Late payments pose a significant hurdle for small businesses, frequently disrupting cash flow and complicating the management of daily operations. Recognising this challenge, we’re dedicated to helping you receive payments more efficiently by expanding your payment options. Building on our existing support for credit cards, debit cards, Apple Pay, and Google Pay, we’re excited to announce the addition of Pay by Bank.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

Accounting Today

MAY 26, 2025

Firms can benefit when more partners have an administrative assistant to help with their work.

Insightful Accountant

MAY 29, 2025

In this special GrowCon 2025 edition of the Accounting Insiders Podcast, host Gary DeHart sits down with Mike Milanbetter known as "Cash Flow Mike"to discuss his transformation from state trooper to entrepreneur, author, and small business coach.

Basis 365

MAY 25, 2025

When your company is growing (more sales, more hires, more expenses) the margin for error in your cash flow shrinks fast. One unexpected delay in receivables or a surprise cost can throw your entire payroll off balance. But heres the good news: this doesnt have to be your reality. With the right tools, the right rhythm, and the right support system, you can build a financial operation that catches these issues early so you have time to react.

CPA Practice

MAY 29, 2025

Tax and accounting professionals are leveraging new technologies to make their firms more efficient and to stay ahead of competitors. In this webinar, well show you how. From automated return package assembly and delivery that takes less than four minutes to send, to AI-powered intake that saves the countless hours necessary to manually handle document request lists and client material organization, and moredigital solutions that consolidate tech stacks are helping firms spend more resources on

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Xero

MAY 28, 2025

If the thought of lodging your tax return makes your palms sweaty and you find yourself procrastinating to avoid the inevitable, youre not alone. Xeros latest research has found nearly three quarters of Australians are worried or anxious about tax time this year. This end of financial year (EOFY), we wanted to uncover the universal challenges that Aussies face and common knowledge gaps when it comes to tax time, and provide easy-to-understand information to reduce confusion and anxiety at this t

Accounting Today

MAY 29, 2025

Areas around Jackson Hole, Aspen, Palm Beach, Miami, New York, Dallas and Austin are in the group. Other top performers may come as more of a surprise.

Going Concern

MAY 29, 2025

Struggling to Find Remote Accounting Talent? Weve Got You Covered. If your firm or internal team is having a tough time sourcing qualified remote tax and accounting professionals, you’re not aloneand you’re not out of options. Accountingflys Always-On Recruiting gives you immediate access to a curated pool of top remote candidates with no upfront cost.

LSLCPAs

MAY 29, 2025

In construction, its not just the concrete that holds things togetherits cost control. Managing expenses isnt just a line item; its the backbone of a construction firms financial health and long-term profitability. The process of cost management requires the following: In-depth tracking Planning Cost controls from project initiation to completion By managing costs effectively, construction.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

CPA Practice

MAY 29, 2025

Companies like Brex, Bluevine, and Wave are already using Plaid's existing Transactions product to deliver real-time spend tracking, smarter capital access, and automated bookkeeping to businesses.

Insightful Accountant

MAY 27, 2025

In this episode of the Accounting Insiders Podcast, host Gary DeHart speaks with Debra Kilsheimer of Behind the Scenes Financials Inc., who shares her inspiring and unconventional journey through the world of accounting.

Accounting Today

MAY 29, 2025

Firm owners looking at succession must look at future state needs, not just current ones.

ThomsonReuters

MAY 27, 2025

What is Thomson Reuters ONESOURCE? Thomson Reuters ONESOURCE is a state-of-the-art tax platform that provides everything corporate tax departments and IT personnel need to manage indirect and direct tax calculations, reporting, and compliance. Used by companies worldwide, ONESOURCE operates at the intersection of commerce and trade, allowing companies to conduct business without being bogged down by technical drama and busy work.

Speaker: Frank Taliano

Documents are the backbone of enterprise operations, but they are also a common source of inefficiency. From buried insights to manual handoffs, document-based workflows can quietly stall decision-making and drain resources. For large, complex organizations, legacy systems and siloed processes create friction that AI is uniquely positioned to resolve.

Patriot Software

MAY 27, 2025

As many as 98% of organizations provide full or partial cell phone reimbursement to employees for their mobile phone expenses. You might have a few questions about mobile phone reimbursements. How do you handle mobile phone reimbursements when it comes to taxes? Are cell phone reimbursements required by law? Read on for the scoop.

Randal DeHart

MAY 30, 2025

Running a small business is exciting, but lets be honest, managing the admin side of things can feel overwhelming. Between keeping financial records, looking after daily operations, and ensuring compliance with tax laws, its easy to feel buried under endless to-do lists. But heres the good news: with the right strategies, small business administration doesnt have to be a headache.

Insightful Accountant

MAY 27, 2025

This event is open to any attendee registered at Scaling New Heights 2025. On the evening of Monday, June 23, 2025, something extraordinary is happening at Howl at the Moon in Orlando.

Accounting Today

MAY 29, 2025

The cloud ERP provider has been acquired by a private equity firm that specializes in enterprise software, data and technology-enabled businesses.

Advertiser: Paycor

Great leadership development is the key to sustainable business growth. Are you ready to design an effective program? HR can use Paycor’s framework to: Set achievable goals. Align employee and company needs. Support different learning styles. Empower the next generation of leaders. Invest in your company’s future with a strong leadership development program.

Let's personalize your content