What 2020 Has Taught Us About Business Resiliency

SingleTrackAccounting

DECEMBER 2, 2020

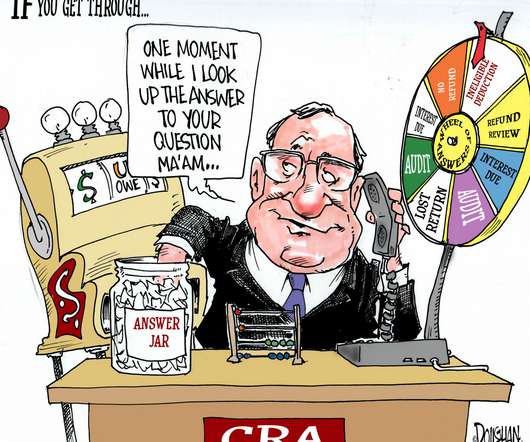

I’m talking about a little time called the beginning of 2020. Was your business prepared? With all this madness ending on the horizon, we are going to highlight some lessons we have learned this year and how to better prepare your business for a downturn in the hopefully not so near future. . Photo Credit: IG/@michaelmowery.

Let's personalize your content