$1B in 2020 tax refunds remains unclaimed

Accounting Today

MARCH 25, 2024

Time is running out for nearly 940,000 individuals to claim refunds from 2020, with a May 17 deadline approaching for filing the necessary tax returns.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Accounting Today

MARCH 25, 2024

Time is running out for nearly 940,000 individuals to claim refunds from 2020, with a May 17 deadline approaching for filing the necessary tax returns.

RogerRossmeisl

JUNE 3, 2021

In recent months, there have been a number of tax changes that may affect your individual tax bill. Here are two changes that may result in tax savings for you on your 2020 or 2021 tax returns. The 2020 return was due on May 17, 2021 (because the IRS extended many due dates from the usual April 15 this year).

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

RogerRossmeisl

FEBRUARY 13, 2021

The IRS opened the 2020 individual income tax return filing season on February 12. You can potentially protect yourself from tax identity theft — and there may be other benefits, too. You can potentially protect yourself from tax identity theft — and there may be other benefits, too. How is a person’s tax identity stolen?

CPA Practice

MARCH 26, 2024

By Alvin Buyinza, masslive.com (TNS) Nearly 940,000 Americans have unclaimed tax returns from 2020 and face a May 17 deadline if they want to get it back, the IRS announced on Monday. The average median refund was $932 for 2020, according to the IRS. If they don’t, their returns become the property of the U.S.

RogerRossmeisl

MARCH 14, 2021

If you’re getting ready to file your 2020 tax return, and your tax bill is higher than you’d like, there might still be an opportunity to lower it. If you qualify, you can make a deductible contribution to a traditional IRA right up until the April 15, 2021 filing date and benefit from the tax savings on your 2020 return.

TaxConnex

DECEMBER 22, 2020

Someday people will probably use a lot of words to describe 2020. “Un-eventful” The year’s ongoing pandemic affected almost every aspect of life – including, and in no small way, sales tax, which was already an area that has seen unprecedented change since the Supreme Court’s Wayfair decision in 2018. Even so, sales tax moved forward.

TaxConnex

FEBRUARY 27, 2024

Your sales tax obligations depend on knowledge and that knowledge often resides in a professional tax specialist (usually an accountant) who helps your company meet its sales tax obligations. This is a complicated time for sales tax obligations – and a terrible time to try to hire an accountant. from 2020 and down 15.9%

RogerRossmeisl

FEBRUARY 26, 2021

If you’re like many Americans, letters from your favorite charities may be appearing in your mailbox acknowledging your 2020 donations. But what happens if you haven’t received such a letter — can you still claim a deduction for the gift on your 2020 income tax return? It depends.

CTP

APRIL 15, 2021

There have been so many tax changes this year! We’ll try to highlight a handful of changes that we think will be most relevant to you as a tax professional. The post 2020 Tax Update for the Tax Planner – Part 1 appeared first on certifiedtaxcoach. As you might expect, it is difficult to cover them all.

CTP

APRIL 17, 2021

There have been so many tax changes this year! The post 2020 Tax Update for the Tax Planner – Part 2 appeared first on certifiedtaxcoach. 2020 Tax Update for the Tax Planner – Part 2 was first posted on April 17, 2021 at 9:00 am. As you might expect, it is difficult to cover them all.

RogerRossmeisl

OCTOBER 6, 2021

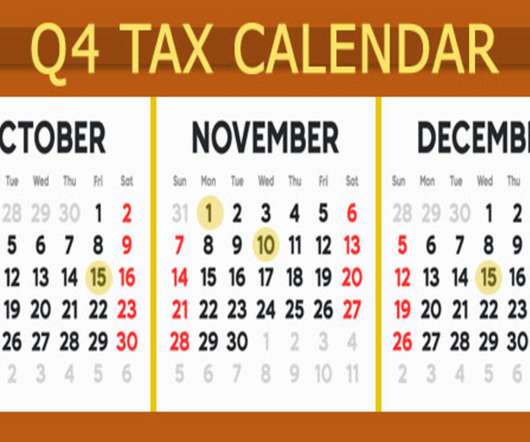

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2021. Note: Certain tax-filing and tax-payment deadlines may be postponed for taxpayers who reside in or have a business in federally declared disaster areas.

RogerRossmeisl

MAY 20, 2022

million households owned mutual funds in mid-2020. But despite their popularity, the tax rules involved in selling mutual fund shares can be complex. What are the basic tax rules? As such, the maximum federal income tax rate will be 20%, and you may also owe the 3.8% net investment income tax.

RogerRossmeisl

NOVEMBER 2, 2021

If your small business hires a “targeted group” member, you are afforded the ability to claim the lucrative federal Work Opportunity Tax Credit (WOTC) for a portion of wages paid to such an individual. TCDTRA 2020 extended the WOTC to cover qualified first-year wages paid to eligible new hires who begin work by 12/31/25.

RogerRossmeisl

JANUARY 18, 2021

Here are some of the key Q1 2021 tax deadlines affecting businesses and other employers. In addition to the Q1 2021 tax deadlines, contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. January 15 Pay the final installment of 2020 estimated tax.

Withum

FEBRUARY 20, 2024

The goal of minimizing tax liability likely drives a desire to discover new advantages in the tax law. If this sounds familiar to you, when planning for the upcoming tax year, a great place to start is with the basics. Let’s Chat The post 2024 Tax Pocket Guide appeared first on Withum. We can help.

RogerRossmeisl

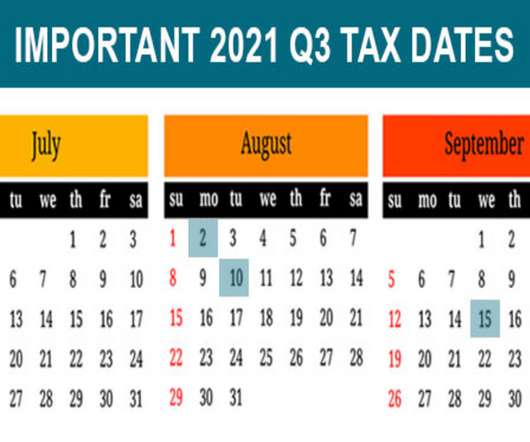

JULY 27, 2021

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2021. Monday, August 2 Employers report income tax withholding and FICA taxes for second quarter 2021 (Form 941) and pay any tax due.

TaxConnex

AUGUST 26, 2021

trillion in 2020. Cross-border e-commerce sales worldwide grew more than 20% in 2020. e-commerce grew more than 40% in 2020. Amazon’s net profit grew more than 80% in 2020. According to the National Retail Federation, non-store and online sales are expected to grow 18% to 23% this year over 2020.

Withum

MARCH 7, 2024

The VDP allow taxpayers to keep 20% of the ERC claimed, tax free, as well as the interest received, but taxpayers must apply to the program by March 22, 2024, and agree to extend the statute of limitations. Should I File a Protective Income Tax Refund Claim? To prevent this, taxpayers can file a protective income tax refund claim.

CPA Practice

APRIL 17, 2024

“The notice provides that if certain requirements are met, a plan will not fail to be qualified for failing to make a specified RMD in 2024, and a taxpayer will not be assessed an excise tax for failing to take the RMD,” the IRS said in a statement on Tuesday. of this notice), the IRS will not assert that an excise tax is due under § 4974.

RogerRossmeisl

JANUARY 25, 2021

If you’re fortunate to get a PPP loan to help during the COVID-19 crisis (or you received one last year), you may wonder about the PPP loan tax consequences. Background on the loans In March of 2020, the CARES Act became law. The post PPP Loan Tax Consequences appeared first on Roger Rossmeisl, CPA.

MyIRSRelief

MAY 19, 2023

With this bustling economy comes a complex tax system, which can be overwhelming and confusing for many taxpayers. Whether you are a small business owner, self-employed, or an individual taxpayer, you may face tax issues such as tax audits, back taxes, and 941 payroll tax problems. Contact us for tax help today.

RogerRossmeisl

JULY 27, 2021

If you’re getting ready to retire, you’ll soon experience changes in your lifestyle and income sources that may have numerous tax implications. You generally must start taking withdrawals from your IRA, SEP, SIMPLE and other retirement plan accounts when you reach age 72 (70½ before January 1, 2020). The post Retiring Soon?

RogerRossmeisl

DECEMBER 28, 2020

If so, you can cash in on depreciation tax savers such as §179 for business property. The election provides a tax windfall to businesses, enabling them to claim immediate deductions for qualified assets, instead of taking depreciation deductions over time.

TaxConnex

AUGUST 19, 2021

In the fall of 2020, I published an article on how the sales tax picture is changing due to COVID-19. Now that we’re over a year into the pandemic, I wanted to provide an update on the sales tax landscape, what predictions have remained the same and what’s changed. in 2020 — reportedly the biggest year-over-year jump for U.S.

RogerRossmeisl

APRIL 25, 2023

Once you file your 2022 tax return, you may wonder what personal tax papers you can throw away and how long you should retain certain records. You may have to produce those records if the IRS audits your return or seeks to assess tax. It’s a good idea to keep the actual returns indefinitely.

Cherry Bekaert

APRIL 21, 2023

The Internal Revenue Service (IRS) recently released Notice 2023-21 clarifying how the postponed tax return filing deadlines in 2020 and 2021 affect amended return filings. In April 2020, the IRS issued Notice 2020-23 , which postponed certain 2019 federal tax return filing and payment deadlines until July 15, 2020.

RogerRossmeisl

FEBRUARY 23, 2021

A number of tax-related limits that affect businesses are annually indexed for inflation, and many have increased for 2021. And the deduction for business meals has doubled for this year after a new law was enacted at the end of 2020. million for 2020) Phaseout: $2.62 million for 2020) Phaseout: $2.62 million (up from $1.04

RogerRossmeisl

MAY 4, 2021

The May 17 deadline for filing your 2020 individual tax return is coming up soon. It’s important to file and pay your tax return on time to avoid penalties imposed by the IRS. The post Importance of Meeting Tax Return and Payment Deadlines appeared first on Roger Rossmeisl, CPA. Here are the basic rules.

CPA Practice

FEBRUARY 12, 2024

9 that includes updated frequently asked questions (FAQs) about the Premium Tax Credit. The Affordable Care Act’s refundable Premium Tax Credit was created to help lower- and middle-income Americans pay for health insurance purchased through the healthcare marketplace ( HealthCare.gov ). The IRS released a fact sheet on Feb.

RogerRossmeisl

FEBRUARY 24, 2021

Many people are more concerned about their 2020 tax bills right now than they are about their 2021 tax situations. That’s understandable because your 2020 individual tax return is due to be filed in less than two months (unless you file an extension). Below are some Q&As about tax amounts for this year.

RogerRossmeisl

SEPTEMBER 27, 2021

over July of 2020. Be aware of the tax implications if you’re selling your home or you sold one in 2021. You may owe capital gains tax and net investment income tax (NIIT). The post Will you Owe Tax on Profits from Selling Your Personal Residence? appeared first on Roger Rossmeisl, CPA.

TaxConnex

FEBRUARY 11, 2021

And it might land right on your company’s bottom line after sales and use tax obligations. Expected s pending on Valentine’s Day gifts this year dropped to an average $164.76 , down about $32 from a record high in 2020 , according to the National Retail Foundation. Sales tax compliance can seem overwhelming, but it doesn’t have to be

CPA Practice

APRIL 9, 2024

But when it comes to taxes, misleading information on social media can lead to financial or even legal problems, the IRS warns. Social media—things like Facebook, Instagram and TikTok—can be used to circulate “wildly inaccurate tax advice,” the agency said. It is not a form the average taxpayer can use to avoid tax bills, the IRS said.

TaxConnex

OCTOBER 7, 2021

There’s always something changing in the world of tax, especially sales tax. There are currently five states with no state-level sales tax. Alaska has long heard rumblings of a statewide sales tax. First came the state’s Remote Seller Sales Tax Commission of municipalities banding together to tax sales.

CPA Practice

OCTOBER 16, 2023

The projected gross tax gap—the difference between the total taxes owed to the federal government and how much is collected on time—increased to $688 billion for tax year 2021, the IRS said on Oct. And the IRS said last Thursday that it will provide tax gap estimates on an annual basis going forward.

RogerRossmeisl

JULY 11, 2021

The Employee Retention Tax Credit (ERTC) is a valuable tax break that was extended and modified by the American Rescue Plan Act (ARPA), enacted in March of 2021. Here’s a rundown of the rules for businesses that have considered revisiting the Employee Retention Tax Credit.

CPA Practice

JANUARY 26, 2024

23, 2024, to two years in prison for a scheme to file false tax returns, and to two years in prison for an unrelated online romance scam. According to court documents and statements made in court related to the tax scheme, Iona Coates owned and operated Bits & Bytes Accounting Services Inc., In December 2020, U.S.

TaxConnex

MAY 2, 2023

Mike Dunleavy is reportedly preparing to introduce a sales tax as part of a long-term budget plan for the state. Five states don’t have a statewide sales tax: New Hampshire, Oregon, Montana, Alaska and Delaware (aka the “NOMAD” states). Vermont was the last state to adopt a sales tax, in 1969.

RogerRossmeisl

AUGUST 5, 2021

From June 2020 through June 2021, the U.S. You should be aware that the way you handle some of your initial expenses can make a large difference in your federal tax bill. The post How New Business Start-up Expenses are Handled on your Tax Return appeared first on Roger Rossmeisl, CPA.

TaxConnex

JANUARY 11, 2022

It’s one of the most important aspects of an online business – and one of the wackiest when trying to determine whether sales tax applies or not. Year over year from 2019 to 2020, package deliveries jumped 147% in the spring, 130% in the summer and 101% over the fall and holidays. Shipping does not incur sales tax in Missouri.

TaxConnex

AUGUST 3, 2021

There’s always something changing in the world of tax, especially sales tax. States themselves don’t seem to know yet, according to a recent survey co-sponsored by the Tax Policy Center. Online sales dipped in May, yet sales tax revenues seem to remain robust thanks in part to online sales. Minnesota Gov.

LSLCPAs

NOVEMBER 18, 2020

Part THREE: PPP Loans, Required Minimum Distributions, and 401(k)s SO much has happened this year and SO much has to be done before the year-end to help our clients make the correct decisions on their tax liabilities that we are starting our planning now, and we hope you will too. […].

LSLCPAs

NOVEMBER 12, 2020

Part TWO: The CARES Act, Net Operating Losses, and Cash Flow So much has happened this year and so much has to be done before the year end to help our clients make the correct decisions on their tax liabilities that we are starting our planning now, and we hope […].

CPA Practice

APRIL 11, 2024

The Justice Department is advising taxpayers to choose their return preparers wisely as the April 15 federal tax filing deadline approaches. Unscrupulous preparers who include errors or false information on a tax return could leave a taxpayer open to liability for unpaid taxes, penalties and interest.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content