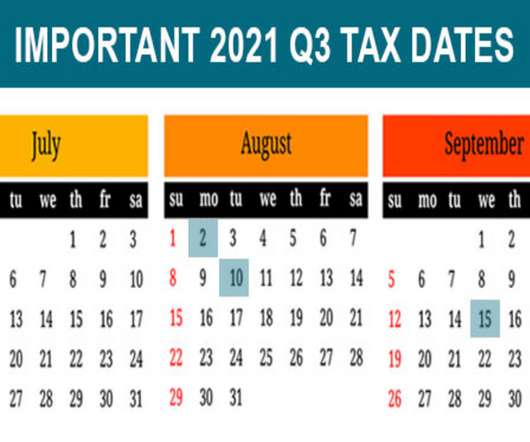

Q3 2021 Tax Deadlines for Businesses

RogerRossmeisl

JULY 27, 2021

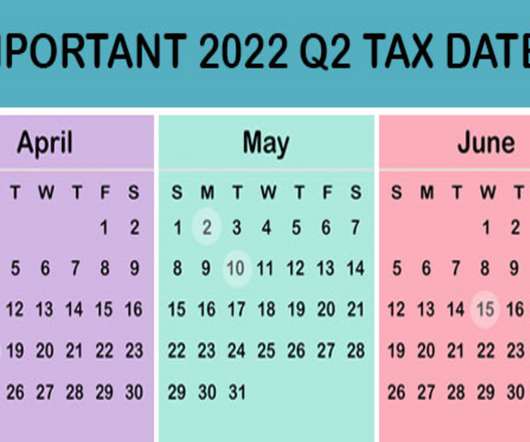

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2021. Monday, August 2 Employers report income tax withholding and FICA taxes for second quarter 2021 (Form 941) and pay any tax due.

Let's personalize your content