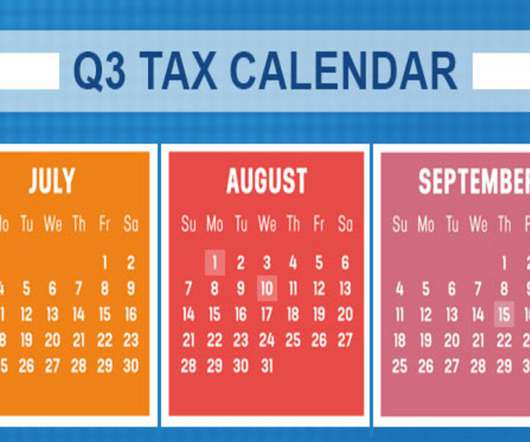

2022 Q3 Tax Calendar for Businesses and Other Employers

RogerRossmeisl

JULY 16, 2022

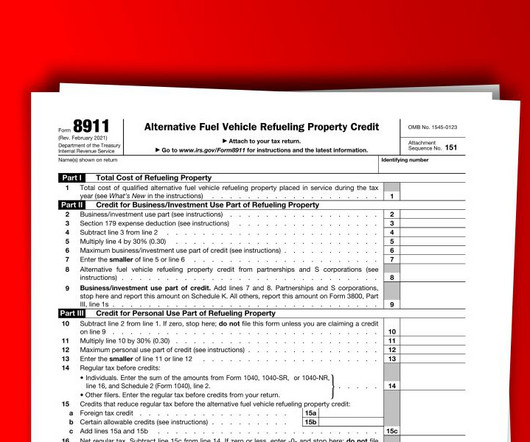

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2022. August 1 Report income tax withholding and FICA taxes for second quarter 2022 (Form 941), and pay any tax due. See the exception below, under “August 10.”)

Let's personalize your content