Get Ready for the 2023 Gift Tax Return Deadline

RogerRossmeisl

FEBRUARY 25, 2024

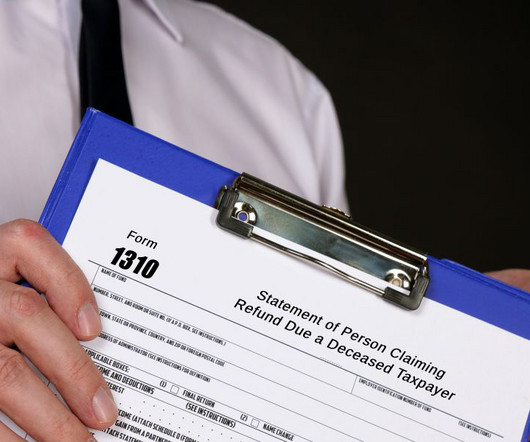

If so, it’s important to determine if you’re required to file a 2023 gift tax return. The annual gift tax exclusion has increased in 2024 to $18,000 but was $17,000 for 2023. The post Get Ready for the 2023 Gift Tax Return Deadline appeared first on Roger Rossmeisl, CPA. Who must file?

Let's personalize your content