Federal Court Shuts Down New York Tax Preparer

CPA Practice

JULY 17, 2024

A federal court in the Eastern District of New York issued a permanent injunction yesterday against a Brooklyn, New York, tax return preparer. 5, Jacob pleaded guilty to aiding and assisting in the preparation of a false tax return. Hubbert of the Justice Department’s Tax Division made the announcement.

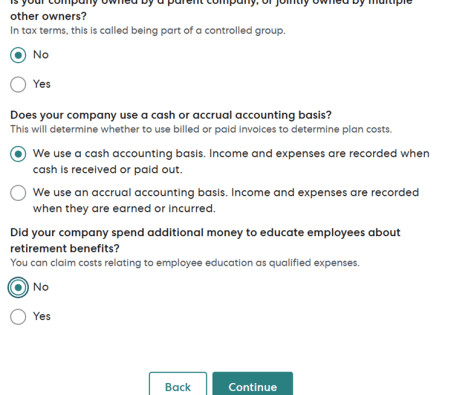

Let's personalize your content