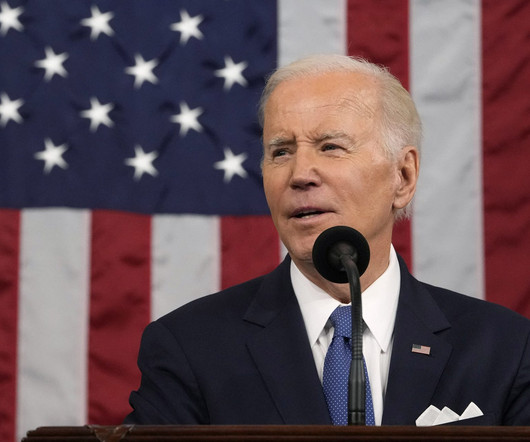

Tax Expert at Wolters Kluwer Gives Opinion on Biden 2024 State of the Union Address

CPA Practice

MARCH 7, 2024

In his State of the Union speech, President Biden announced a proposal to deny corporations a tax deduction when they pay more than $1 million to any employee. He also described his plans to bump the corporate tax rate up to 28 percent from the level set by former President Trump’s 2017 tax cuts, which put it at 21 percent.

Let's personalize your content