Tax Framework Released: Tax Relief for American Families and Workers Act of 2024

Withum

JANUARY 16, 2024

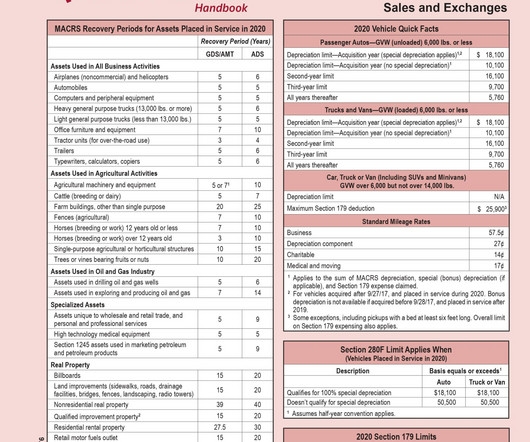

We are excited to announce that Ways and Means Chairman Jason Smith (R-MO) and Senate Finance Committee Chairman Ron Wyden (D-OR) released a bipartisan tax framework that promotes Main Street businesses, while also providing more financial security to families in need. For the 2023 taxable year, a 179 expense of $1.16 million.

Let's personalize your content