Congress Passes One Big Beautiful Bill – President to Sign on July 4

Withum

JULY 4, 2025

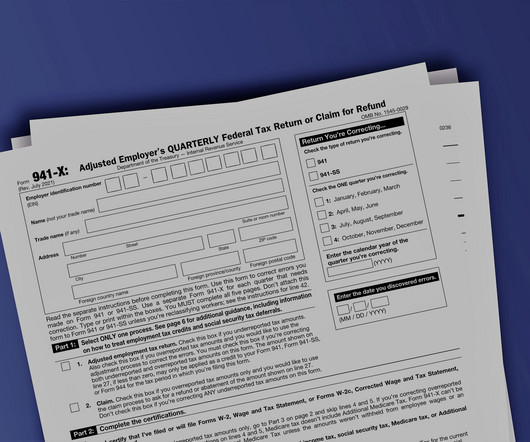

One Big Beautiful Bill Tax Provisions The One Big Beautiful Bill includes the following significant federal income tax provisions. This would provide that an amended return be filed for 2022, and 2023. If a 2024 tax return has already been filed, then an amendment would be required.

Let's personalize your content