Colorado Businessman Gets 15 Months for $737K Employment Tax Evasion

CPA Practice

JULY 23, 2023

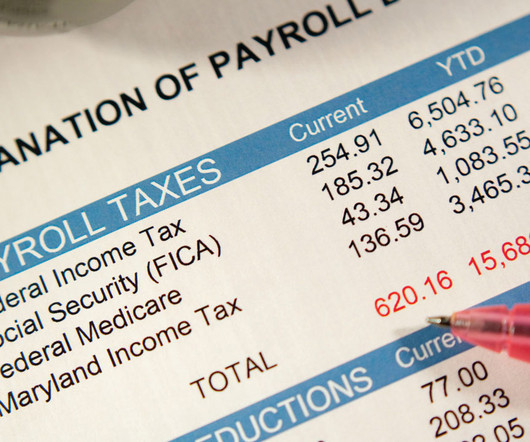

A Colorado man has been sentenced to 15 months in prison for evading the payment of more than $700,000 in employment taxes he owed to the IRS. After failing to collect from the businesses, the IRS assessed the tax against Stevens personally. In total, Stevens caused a tax loss of approximately $737,128.

Let's personalize your content