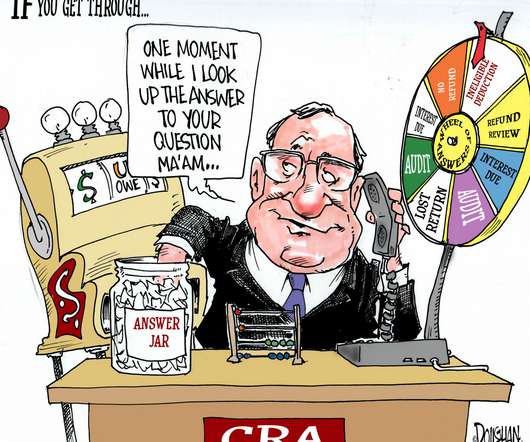

Professional tax help Chicago: Taxpayers Facing Tax Audits, Back Taxes, and 941 Payroll Tax Problems

MyIRSRelief

MAY 22, 2023

Chicago, Illinois is home to numerous businesses and individuals who may face tax-related challenges such as tax audits, back taxes, and payroll tax problems. Contact us for tax help today. Contact us for tax help today.

Let's personalize your content