5 ways technology can strengthen a corporate tax team

ThomsonReuters

FEBRUARY 16, 2024

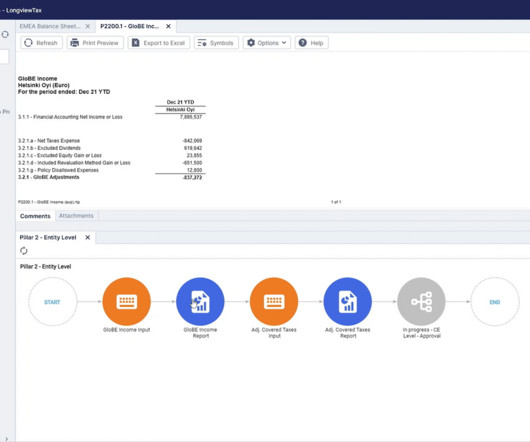

The proper utilization and deployment of technological solutions alongside valued tax professionals is how successful tax departments deliver valued analysis, insights, and guidance for their organizations. Keeping regulators at bay Tax authorities worldwide continue to pass legislation requiring greater disclosure from corporations.

Let's personalize your content