Checklist for Small Business Startups

SMBAccountant

MAY 17, 2024

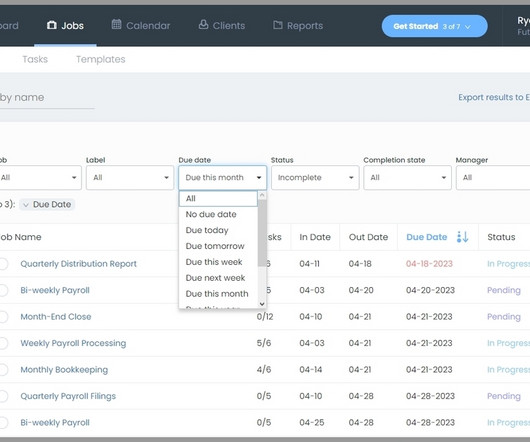

It also keeps people out of your personal accounts that you probably don’t want to be there. Accounting Software (Hire an accountant and/or bookkeeper) Small businesses should consider using accounting software instead of Excel or other record keeping options due to its automation, efficiency, and reliability in managing financial tasks.

Let's personalize your content