Wolters Kluwer to Add New AI Features to Tax and Accounting Systems

CPA Practice

MAY 3, 2024

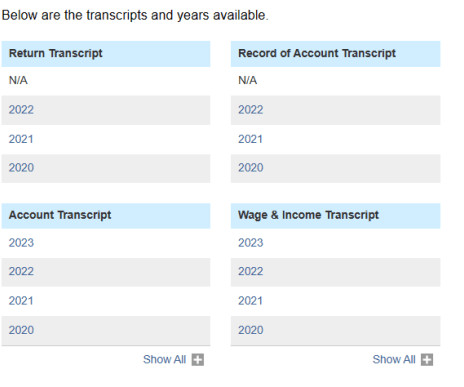

The new GenAI search functionality queries trusted sources within Wolters Kluwer content helping customers when preparing tax returns and identifying tax planning opportunities.

Let's personalize your content