Accounts payable vs. accounts receivable: What are the differences?

ThomsonReuters

APRIL 6, 2023

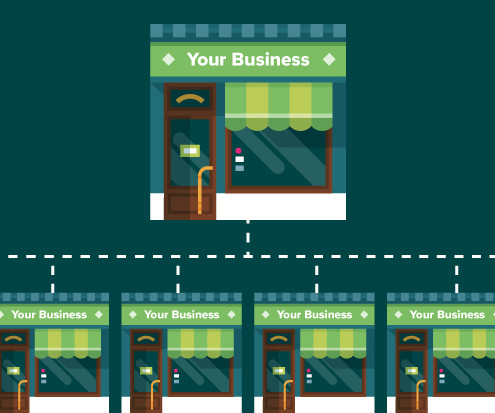

Accounts payable and accounts receivable are opposite but interconnected procedures. Together, they comprise the very basics of business and can be used to gauge financial health. When accounts payable and accounts receivable are in balance, a business can plan ahead for growth.

Let's personalize your content