What is IRS Form 941?

ThomsonReuters

FEBRUARY 28, 2022

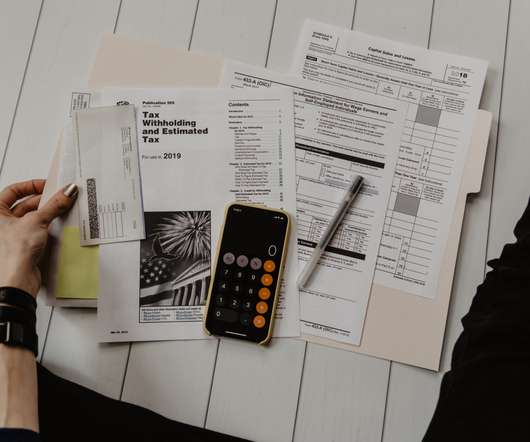

Highlight: The IRS Form 941 is one of the most important payroll-related tax returns used by businesses to report employment taxes, including federal income tax withholding, Social Security tax, Medicare tax, and Additional Medicare tax. What taxes are reported on Form 941?

Let's personalize your content