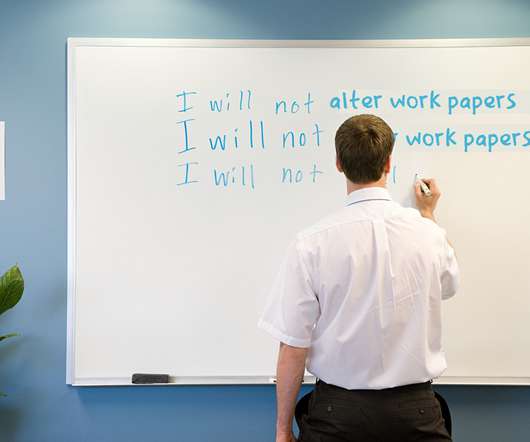

New PCAOB Rules Would Push Auditors to Assemble Final Documentation More Quickly

CPA Practice

MAY 14, 2024

The Public Company Accounting Oversight Board (PCAOB) approved a sweeping new standard on the general responsibilities of an auditor on May 13, including a provision that significantly cuts the maximum time period for the auditor to assemble a complete and final set of audit documentation from 45 days to 14 days.

Let's personalize your content