IRS Releases 2022 Versions of HSA Reporting Forms

ThomsonReuters

DECEMBER 16, 2021

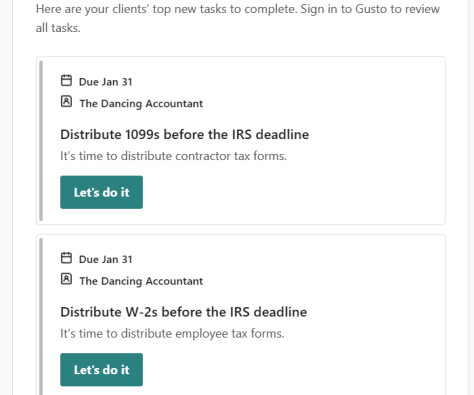

Form 5498-SA (HSA, Archer MSA, or Medicare Advantage MSA Information) (2022); Instructions for Forms 1099-SA and 5498-SA (2022). Form 5498-SA. Form 1099-SA and 5498-SA Instructions. EBIA Comment: The 2022 forms should not be used until 2023, when reporting for the 2022 tax year is due.

Let's personalize your content