Balancing automation and compliance in expense reporting

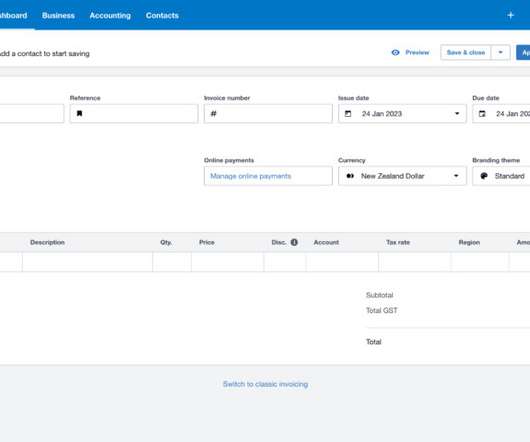

Xero

AUGUST 29, 2023

This guest blog post was written by the team at financial management app, Expensify. What your employees are expected to do with that receipt kicks off almost everything that follows in your expense management process. Finding the right balance between automation and compliance in any business process can be challenging.

Let's personalize your content