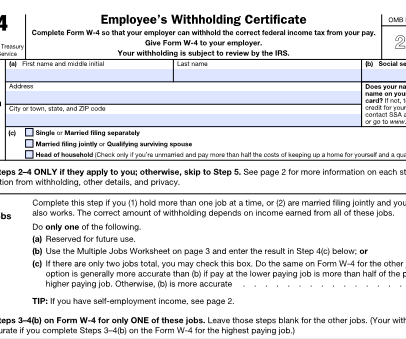

IRS Makes Minor Changes to 2023 W-4 Form

CPA Practice

FEBRUARY 15, 2023

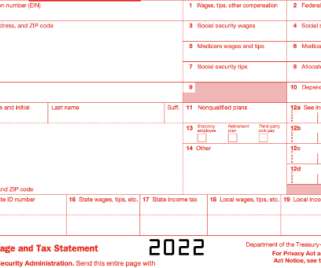

The new W-4 form for 2023 is now available. Unlike the big W-4 form shakeup of 2020, there aren’t significant changes to the new form. You may not file Form W-4 with the IRS, but your payroll depends on it. New W-4 form 2023: Changes So, what’s new with the 2023 W-4 form?

Let's personalize your content