What Is Payroll Tax? A Breakdown for Business Owners

inDinero Tax Tips

MAY 13, 2024

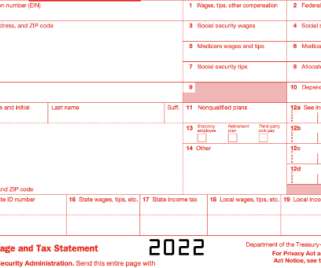

What is payroll tax? Since businesses are responsible for calculating, withholding, and remitting the tax to the government, navigating this process can be an administrative challenge. In this article, we’ll explain the basics of the tax and how to do payroll yourself. How Much Is Payroll Tax?

Let's personalize your content