Las Vegas Restaurateur Bamboozled His Accountant Into Filing Phony Tax Returns

Going Concern

JANUARY 10, 2024

Today in clients behaving badly, the DoJ announced Friday that Las Vegas restaurateur Raul Gil, who owns and operates three Casa Don Juan restaurants in the city, is headed to prison for 37 months for evading his federal income taxes.

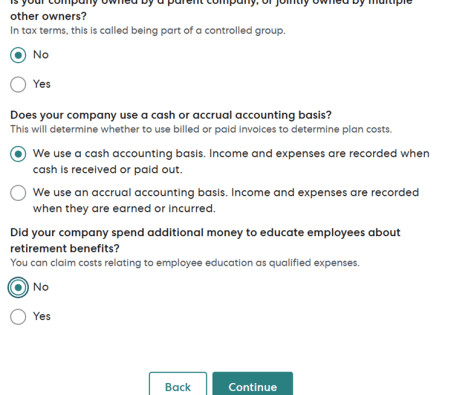

Let's personalize your content