How To Download Your IRS Account Transcript to Look Up Your Estimated Tax Payments (Updated Jan 2024)

Nancy McClelland, LLC

JANUARY 16, 2024

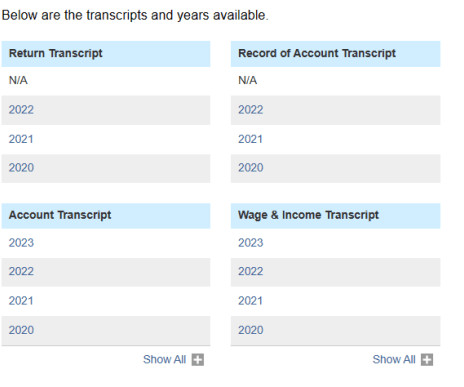

An Account Transcript lists information on payments and credits posted to your account throughout the year, such as quarterly estimated tax payments. The best news where downloading any transcript is concerned? How Can I Download My IRS Transcript?” From the IRS website , you’ll need to create an ID.me ” Seriously?

Let's personalize your content