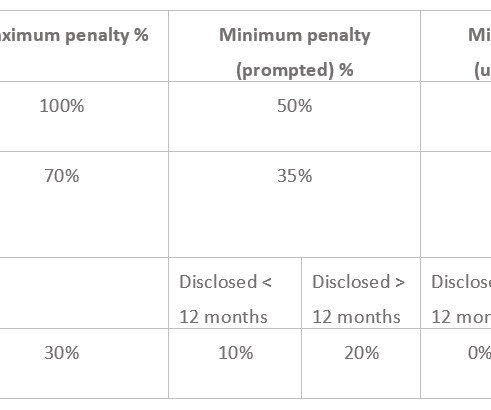

HMRC Powers if you deliberately evade tax

Menzies

MARCH 25, 2024

Menzies LLP - A leading chartered accountancy firm. If you don’t declare or don’t pay the tax you owe to HMRC, it’s likely you will receive significant penalties and in some cases be criminally prosecuted. What should I do if I am concerned about PDDD or MSD?

Let's personalize your content