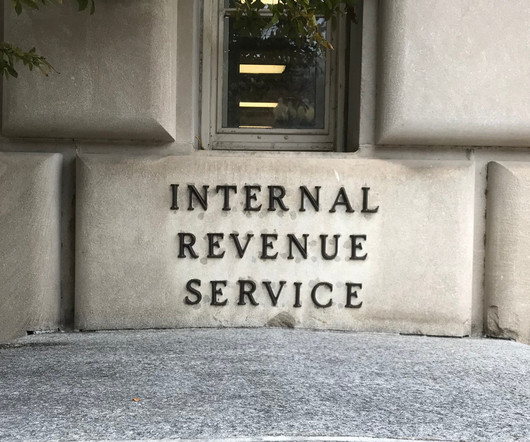

Is Your Income Tax Withholding Adequate?

RogerRossmeisl

SEPTEMBER 19, 2022

Receiving a tax refund essentially means you’re giving the government an interest-free loan. Adjust if necessary Taxpayers should periodically review their tax situations and adjust withholding, if appropriate. The post Is Your Income Tax Withholding Adequate? appeared first on Roger Rossmeisl, CPA.

Let's personalize your content