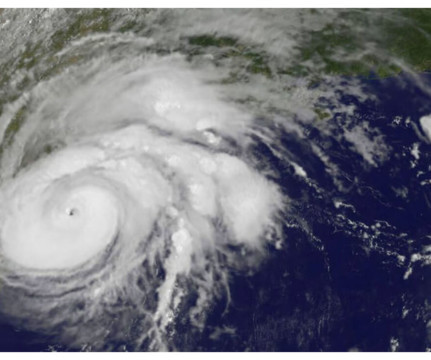

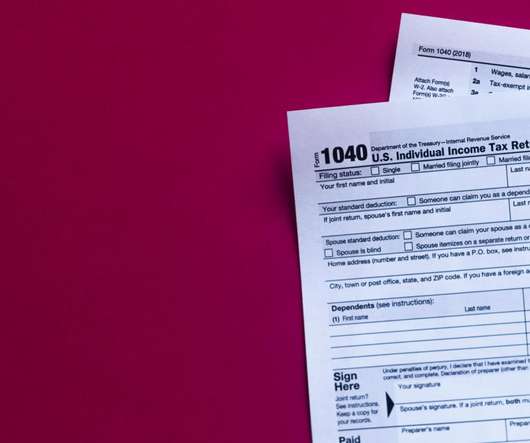

IRS Offers Tax Deadline Extensions for Louisiana Due to Hurricane Francine

CPA Practice

SEPTEMBER 13, 2024

The Internal Revenue Service is offering tax deadline relief for individuals and businesses in the entire state of Louisiana, affected by Tropical Storm Francine that began on Sept. 3, 2025, to file various federal individual and business tax returns and make tax payments. These taxpayers now have until Feb.

Let's personalize your content