Art of Accounting: Speed, availability and continuity when acquiring a practice

Accounting Today

SEPTEMBER 19, 2022

Accounting Today

SEPTEMBER 19, 2022

RogerRossmeisl

SEPTEMBER 19, 2022

When you filed your federal tax return this year, were you surprised to find you owed money? You might want to change your withholding so that this doesn’t happen again next year. You might even want to adjust your withholding if you got a big refund. Receiving a tax refund essentially means you’re giving the government an interest-free loan. Adjust if necessary Taxpayers should periodically review their tax situations and adjust withholding, if appropriate.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

xendoo

SEPTEMBER 19, 2022

For the most part, business travel expenses are tax deductible, meaning that you could lower the amount of taxes you need to pay. . When it comes to tax-write offs for travel, the IRS provides specific guidelines around what you can claim. Mainly, your trip needs to be primarily for business purposes. However, there is some wiggle room to get a little vacation time in during a business trip that qualifies as a travel expense. .

RogerRossmeisl

SEPTEMBER 19, 2022

As you’re aware, certain employers are required to report information related to their employees’ health coverage. Does your business have to comply, and if so, what must be done? Basic rules Certain employers with 50 or more full-time employees (called “applicable large employers” or ALEs) must use Forms 1094-C and 1095-C to report the information about offers of health coverage and enrollment in health coverage for their employees.

Advertisement

The office of the CFO is rapidly evolving, with more and more demands being placed upon the finance and accounting team each year. Join us in this webinar, where we share 8 things to NOT do when it comes to helping the CFO office advance in supporting the business. Learning Objectives: This course objective is to understand how best to support an organization's finance leadership.

Intuitive Accountant

SEPTEMBER 19, 2022

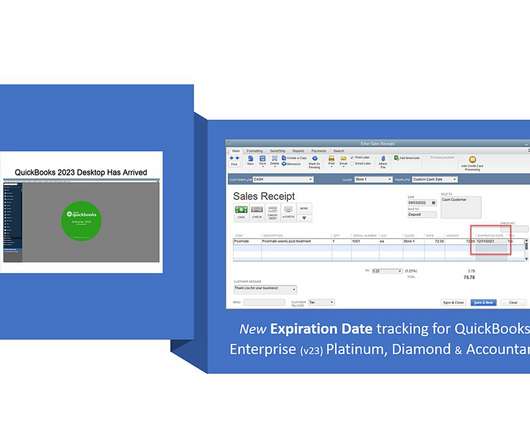

Platinum, Diamond and Accountant subscribers within the US and Canada now can track Expiration Dates as well as their Serial or Lot numbers starting with the new v23.0 edition of QuickBooks Enterprise Solutions.

RogerRossmeisl

SEPTEMBER 19, 2022

You may have heard that the Inflation Reduction Act (IRA) was signed into law recently. While experts have varying opinions about whether it will reduce inflation in the near future, it contains, extends and modifies many climate and energy-related tax credits that may be of interest to individuals. Non-business energy property Before the IRA was enacted, you were allowed a personal tax credit for certain non-business energy property expenses.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

RogerRossmeisl

SEPTEMBER 19, 2022

Summer can bring extreme weather, including floods, droughts, wildfires, tornadoes and hurricanes. These natural disasters and other crises can interrupt normal business operations, causing significant financial losses. If disaster strikes, a business interruption insurance policy can allow you to recoup lost profits, repair damaged assets and cover other incremental expenses.

RogerRossmeisl

SEPTEMBER 19, 2022

If you don’t have enough federal tax withheld from your paychecks and other payments, you may have to make estimated tax payments. This is the case if you receive interest, dividends, self-employment income, capital gains or other income. Here are the applicable rules for paying estimated tax without triggering the penalty for underpayment. When are the payments due?

Snyder

SEPTEMBER 19, 2022

From e-commerce stores to SaaS startups, businesses need to receive payments from customers , and payment gateways are one of the most common ways to do this. There are many options for collecting money online – credit cards, Buy Now Pay Later cards, or PayPal, just to name a few. However, not all payment gateways are the same. What you need may depend on your business’s size and needs.

Speaker: Dylan Secrest, Founder of Alamo Innovation and Construction Digital Transformation Consultant

Construction payment workflows are notoriously complex when you consider juggling multiple stakeholders, compliance requirements, and evolving project scopes. Delays in approvals or misaligned data between budgets, lien waivers, and pay applications can grind progress to a halt. The good news? It doesn't have to be this way! Join expert Dylan Secrest to discover how leading contractors are turning payment chaos into clarity using digital workflows, integrated systems, and automation strategies.

Patriot Software

SEPTEMBER 19, 2022

If you’re an employer who’s required to offer health insurance to employees, you may be familiar with Form 1095-C. But, how much do you know about Form 1095-C’s counterpart, IRS Form 1094-C? Get the inside scoop on what is Form 1094-C, how it differs from a 1095-C form, and more. IRS Form 1094-C: Q&A Looking […] READ MORE.

Intuitive Accountant

SEPTEMBER 19, 2022

With many businesses struggling to attract, train and retain qualified talent, what can you do to hit the mark. Insightful Accountant Publisher Gary DeHart shows you how.

Advertisement

You wouldn’t keep using a 2009 flip phone - so why settle for outdated close processes? It’s time for an upgrade. SkyStem's Guide to Month-End Close Software walks you through what today’s best tools can do (and what your team shouldn’t have to deal with anymore). Get smart, fast, and a whole lot less stressed when it’s time to close the books.

Going Concern

SEPTEMBER 19, 2022

Title. Let’s talk about starting salaries in public accounting. Let’s assume a student has an undergraduate accounting degree, a MAcc degree, and has passed all 4 sections of CPA exam. What do we think is a fair starting salary? #Accounting. — Dr. Josh McGowan, CPA (@Jmcgowan3838) September 19, 2022. Starting salaries in #accounting have gone from B school leaders to laggards. 1st year auditors today barely make more than an auditor who started in 2011 in nominal dollars and less in

Going Concern

SEPTEMBER 19, 2022

The Wall Street Journal talks about why the IRS is not going to have an easy time recruiting in this market. A review of EY’s practices after a staff member’s suicide will look at “workplace culture, healthy work practices and psychological safety” and be conducted by an external expert. Teams of PCAOB inspectors arrived at the Hong Kong offices of PwC and KPMG this morning (Monday) to begin a historic review of the audit records of US-listed, China-based companies, two sources told the South Ch

Speaker: Gerald Ratigan

The accounts payable (AP) function is evolving and AI is leading the charge. As finance teams face rising invoice volumes and expectations for speed and accuracy, AI-powered automation has shifted from a futuristic concept to the most practical solution. But for finance leaders, success isn’t just about selecting the right tools, it’s about implementing the right strategy.

Wendy Tietz

SEPTEMBER 19, 2022

The Ford Motor Company (NYSE: F) is selling an electric version of its F-150 pickup truck, the F-150 Lightning electric truck. Ford cannot keep up with demand; it has taken orders for its entire 2022 production capacity and has closed orders for the 2022 model. Ford has not yet begun taking reservations for the 2023 […].

Intuitive Accountant

SEPTEMBER 19, 2022

In today's demanding landscape, the partnership is designed to help free up the time for accountants and their clients.

RogerRossmeisl

SEPTEMBER 19, 2022

The Inflation Reduction Act (IRA), signed into law by President Biden on August 16, contains many provisions related to climate, energy and taxes. There has been a lot of media coverage about the law’s impact on large corporations. For example, the IRA contains a new 15% alternative minimum tax on large, profitable corporations. And the law adds a 1% excise tax on stock buybacks of more than $1 million by publicly traded U.S. corporations.

Intuitive Accountant

SEPTEMBER 19, 2022

A new eBook will show you everything you need to know about leveraging Jirav and other automation strategies to increase revenue for your CAS service line while supporting the future success of your clients.

Speaker: Sean Yoder

Nonprofits are under more pressure than ever to demonstrate financial accountability while continuing to expand their impact. Traditional budgeting models often fall short, reinforcing silos, limiting flexibility, and stalling growth. Enter collaborative budgeting: a dynamic, team-driven process that enables smarter resource allocation and builds financial resilience at scale.

Xero

SEPTEMBER 19, 2022

Bills is one of Xero’s most loved features. It helps you track and pay bills on time, have a clear overview of your accounts payable, and gain a better understanding of your cash flow. As part of our commitment to ‘ Building on Beautiful ’ — which is about continuously upgrading our technology to build new features faster, giving our platform a consistent look and feel, and making sure we keep accessibility top of mind — we’re refreshing the bills experience in Xero.

Let's personalize your content