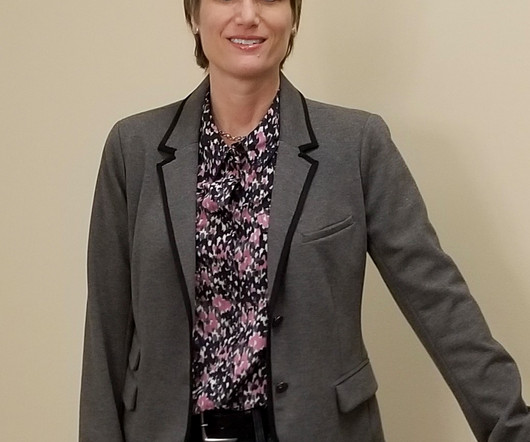

Get to Know TaxConnex: Partner Q&A Series - Jackie Breiter

TaxConnex

MARCH 23, 2023

Looking to find out more about TaxConnex? What better way than hearing from our founders and partners? Learn from the best by hearing from the ones that built TaxConnex. Over the last few months, we've been highlighting the Partners of TaxConnex. Finally, we have our Chief Operating Officer, Jackie Breiter! Can you tell me about your career leading up to TaxConnex?

Let's personalize your content