The accounting implications of a Bitcoin reserve

Accounting Today

JANUARY 10, 2025

The new administration has discussed creating a strategic Bitcoin reserve. What accounting changes would we see as a result?

Accounting Today

JANUARY 10, 2025

The new administration has discussed creating a strategic Bitcoin reserve. What accounting changes would we see as a result?

Going Concern

JANUARY 10, 2025

The Ohio Society of CPAs announced yesterday that their state is leading the way in alternative pathways to CPA licensure, officially. Here’s what they said: Ohio Governor Mike DeWine signed House Bill 238 into law on Jan. 8, which includes OSCPA-backed legislation that will position Ohio as a national leader in addressing the dire CPA shortage.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Randal DeHart

JANUARY 10, 2025

It's amazing how some books stand the test of time. We usually refer to one of our most recommended, Stephen Covey's The 7 Habits of Highly Effective People, when we mentor our contractor clients and employees. Although it was first published three decades ago, its lessons are still incredibly relevant for business owners. You might wonder how these habits fit into today's landscape of changing trends, tight deadlines, and constant distractions.

Accounting Insight

JANUARY 10, 2025

2024 was certainly a year of discovery and rapid progression for AI and automation. We witnessed the widespread adoption of tools like ChatGPT to generate and speed up idea development, create structure and conduct research. This widening use of generative shows a growing acceptance of how it can benefit people in business as well as for personal use.

Speaker: Joe Wroblewski, Sales Engineer Manager

Automating time-consuming manual tasks can save your firm hundreds of hours–and thousands of dollars. But it can also have longer-lasting benefits, like helping you attract and retain the next generation of CPAs, and we don’t need to tell you how important that is amid the current generational staffing crisis in the tax and accounting profession. You'll want to save your seat for this new webinar with industry expert Joe Wroblewski, where we'll explore how to: Maximize ROI with Cost-Effective Te

Accounting Today

JANUARY 10, 2025

Newly expanded and improved tools will be available when tax season kicks off this month.

CPA Practice

JANUARY 10, 2025

Currently, only individuals and households that reside or have a business in Los Angeles County qualify for tax relief. However, the same tax relief will be offered to any counties designated by FEMA in the coming days or weeks.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

CPA Practice

JANUARY 10, 2025

The Grant Thornton global network of accounting firms pulled in a record $8 billion in revenue during its most recent financial year that ended Sept. 30, 2024, a 6.6% increase in U.S. dollars and 8.8% in adjusted constant currency terms over its 2023 revenue of $7.5 billion.

Accounting Today

JANUARY 10, 2025

Ericksen Krentel elects sixth MP; Yeo & Yeo, Grassi and BMSS move offices; IFRS Foundation appoints three new trustees; and more news from across the profession.

CPA Practice

JANUARY 10, 2025

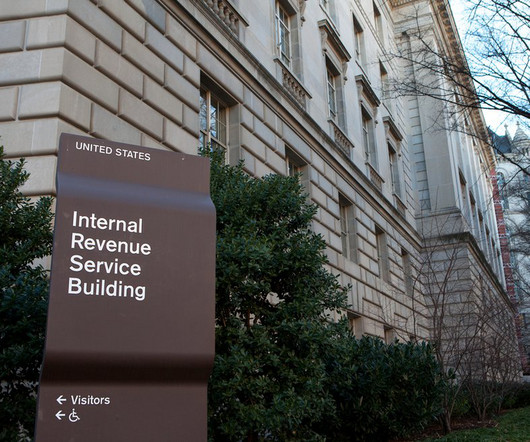

The IRS expects more than 140 million individual tax returns to be filed ahead of the April 15 federal deadline, with more than half of all tax returns filed this year with the assistance of a tax professional.

Accounting Today

JANUARY 10, 2025

Some related-party 'basis shifting' arrangements are now considered 'transactions of interest' per the IRS's final regulations.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

CPA Practice

JANUARY 10, 2025

KPMG finished its 2024 financial year with global revenue of $38.4 billion, a 5.1% increase in local currency terms and 5.4% growth in U.S. currency over the previous year, the Big Four firm said last month.

Accounting Today

JANUARY 10, 2025

The deadline for our Top New Products list has been moved to Wednesday, Jan. 15.

CPA Practice

JANUARY 10, 2025

We've normalized burnout in accounting for too long. We brush it off as an inevitable part of the profession, hiding behind phrases like, "It's just busy season" or "that's public accounting for you.

Accounting Today

JANUARY 10, 2025

The proposed regulations involve several provisions of the SECURE 2.0 Act, including auto enrollment in 401(k) and 403(b) plans, and the Roth IRA catchup rule.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

CPA Practice

JANUARY 10, 2025

This CES was more about "experiences," and we were actively separating reality from hype. Many columns I've read on the CES event don't represent the reality I understood by attending.

Accounting Today

JANUARY 10, 2025

Proposed new rules were issued for the tax credit for qualified commercial clean vehicles, along with guidance on claiming tax credits for clean fuel.

IgniteSpot

JANUARY 10, 2025

On 12/27/24, Bench.co, an online bookkeeping service, suddenly shut down its platform, leaving over 11,000 businesses scrambling. What really happened?

Ronika Khanna CPA,CA

JANUARY 10, 2025

The Canadian real estate market has performed well in recent years, though analysts and economists have long warned of its potential overvaluation. Potential homeowners often find themselves seduced by their vision of the perfect home in the perfect neighbourhood and often end up in a difficult situation, referred to as house poor, where the majority of their disposable income goes to paying down their mortgages.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

CPA Practice

JANUARY 10, 2025

After tying PwC for the lead in the second quarter of 2024, top 25 accounting firm Withum was alone at the top of the initial public offering auditor market share standings in Q3 with 11 audit clients that went public, according to Audit Analytics.

Accounting Today

JANUARY 10, 2025

Regular reviews can determine whether a life insurance policy is performing according to expectations and meeting the client's current financial objectives.

CPA Practice

JANUARY 10, 2025

ABUKAI, a provider of expense management solutions, is offering people who have suffered from the January 2025 California wildfires a free one-year ABUKAI Individual Account.

Accounting Today

JANUARY 10, 2025

Officials are weighing whether the bank now owned by UBS breached a 2014 plea deal in which it paid $2.6 billion and admitted helping Americans evade taxes.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Insightful Accountant

JANUARY 10, 2025

As 1099 season approaches, accountants face the annual challenge of collecting W-9s from contractorsa task often fraught with inefficiencies and missed deadlines. Keeper offers a seamless solution to simplify this process.

Accounting Today

JANUARY 10, 2025

Weeks after Danish judges sentenced the hedge fund trader to 12 years in prison, the country's lawyers turned to a U.S. court to recoup about $500 million.

FraudFiles

JANUARY 10, 2025

Hundreds of thousands of Americans get sucked into Multi-Level Marketing (MLM) companies each year. From Mary Kay to Amway to Herbalife to Avon, the list is seemingly endless. Each offers its own special spin on the products it sells, but the main focus of an MLM is on recruiting new members. (Warning: Theyll deny that [.

Insightful Accountant

JANUARY 10, 2025

I.R.S. Free File opens today, Friday January 10, 2025. IRS Free File can only be started from the IRS Free File webpage at IRS.gov.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Wellers Accounting

JANUARY 10, 2025

Russell Flynn ACA explains how you can claim Research & Development (R&D) tax credits even if you've been awarded a grant.

Going Concern

JANUARY 10, 2025

Footnotes is a collection of stories from around the accounting profession curated by actual humans and published every Friday at 5pm Eastern. While you’re here, subscribe to our newsletter to get the week’s top stories in your inbox every Tuesday and Friday. Comments are closed on Friday Footnotes and the Monday Morning Accounting News Brief by default.

Let's personalize your content