5 Tips to Prepare for Your Best Tax Season

Intuitive Accountant

OCTOBER 16, 2022

With tax season just around the corner, FFP Wealth Management's Joseph Graziano is offering some ways you can start digging in before the crush.

Intuitive Accountant

OCTOBER 16, 2022

With tax season just around the corner, FFP Wealth Management's Joseph Graziano is offering some ways you can start digging in before the crush.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

TaxConnex

OCTOBER 19, 2022

Sales tax, unlike other types of taxes, has many deadlines, not once or twice a year, but often every month and it doesn’t fall on the same day for every business, or state. With sales and use tax compliance, there are six primary deadlines each month – 7 th , 10 th , 15 th , 20 th , 25 th and 30 th – without considering the odd due dates for certain states – 12 th , 23 rd , 24 th , etc.

Canopy Accounting

OCTOBER 19, 2022

Document management is a core element of every accounting project, but it can quickly become a headache if you don’t have a good system in place. Here are a few key things to keep in mind as you create your document management strategy.

Advertisement

The office of the CFO is rapidly evolving, with more and more demands being placed upon the finance and accounting team each year. Join us in this webinar, where we share 8 things to NOT do when it comes to helping the CFO office advance in supporting the business. Learning Objectives: This course objective is to understand how best to support an organization's finance leadership.

Patriot Software

OCTOBER 20, 2022

As a business owner, you are likely familiar with certain accounting accounts, like your assets or expense accounts. But did you know that each account can also be labeled as a permanent or temporary account? Read on to learn the difference between temporary vs. permanent accounts, examples of each, and how they impact your small […] READ MORE.

Randal DeHart

OCTOBER 21, 2022

When you start a small business, it's usually only you behind the whole operation. You wear many hats, from CEO to clean-up crew. As you pour your heart and soul into your business and it begins to grow, the amount of work involved grows. Because a small business focuses on survival, you pay much attention to the bottom line. This makes much sense, but it also leads to being seriously overworked.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

Patriot Software

OCTOBER 19, 2022

For many years, it was typical for employers to discourage discussions about pay in the workplace. And, many businesses had or have pay secrecy policies to prevent employees from talking about their compensation. Nowadays, pay transparency is on the rise to help combat gender inequality at work. In fact, 17% of private companies practice pay […] READ MORE.

Withum

OCTOBER 19, 2022

On October 19, 2022, the IRS issued a press release ( IR-2022-183 ) warning taxpayers to be wary of third parties who advise them to claim an employee retention credit (ERC) when they do not qualify. According to the IRS, these third parties “often charge large upfront fees or a fee that is contingent on the amount of the refund.” The IRS is also concerned that these third parties “may not inform taxpayers that wage deductions claimed on the business’ federal income tax return must be reduced by

BurklandAssociates

OCTOBER 20, 2022

Alejandro Lozano, Founding Principal at Newtype Ventures, shares his perspectives on navigating recent changes in the startup funding market. The post Insights from a VC on Today’s Startup Fundraising Market appeared first on Burkland.

Speaker: Dylan Secrest, Founder of Alamo Innovation and Construction Digital Transformation Consultant

Construction payment workflows are notoriously complex when you consider juggling multiple stakeholders, compliance requirements, and evolving project scopes. Delays in approvals or misaligned data between budgets, lien waivers, and pay applications can grind progress to a halt. The good news? It doesn't have to be this way! Join expert Dylan Secrest to discover how leading contractors are turning payment chaos into clarity using digital workflows, integrated systems, and automation strategies.

SMBAccountant

OCTOBER 19, 2022

Each year the Association of Certified Fraud Examiners puts out a report that identifies trends and key findings related to fraud over the past year. Some of the highlights seem unreal as you look at them for the first time. Here’s some of the findings from the “Occupational Fraud 2022: A Report to the Nations.” Organizations with the FEWEST employees had the highest median loss of $150k showcasing that small businesses are the hardest hit and need to be concerned with the potential for fraud.

TaxConnex

OCTOBER 18, 2022

Our Halloween-month look at tricky items for sales tax continues here with a few items it’s hard to live without…. Clothes. Clothing is taxable in most states and the District of Columbia. Some states (of course) have special sales tax rules for clothing. California, Idaho and Tennessee exempt only clothing sales for some nonprofits, for example. South Carolina, Ohio and Virginia exempt some protective clothing.

Withum

OCTOBER 18, 2022

A cyber Incident Response Plan (IRP) can help an organization prepare to reduce the overall impact of an incident. A potential cyber breach incident can be a ransomware attack , a malicious insider, an external attacker that gained access via a phishing campaign or internal human error, among many others. When dealing with incidents, we often say it is not if, but when an incident will occur.

Speaker: Gerald Ratigan

The accounts payable (AP) function is evolving and AI is leading the charge. As finance teams face rising invoice volumes and expectations for speed and accuracy, AI-powered automation has shifted from a futuristic concept to the most practical solution. But for finance leaders, success isn’t just about selecting the right tools, it’s about implementing the right strategy.

Patriot Software

OCTOBER 19, 2022

The topic of gender equality at work is heavily debated. Do hiring managers place more men than women? Do women earn less than men working the same jobs? Are women passed up for promotion opportunities? According to many studies, the answer is yes to all of the above. You can’t solve the nation’s inequalities. But, […] READ MORE.

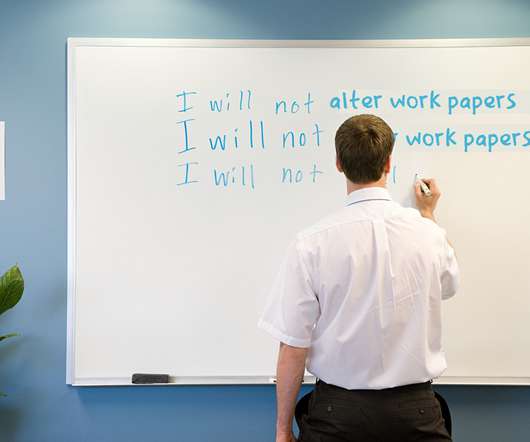

Going Concern

OCTOBER 19, 2022

The PCAOB has made it painfully clear that they are done pussyfooting around and sick of auditors not doing their jobs. Chair Erica Williams said in September the Board plans to use every tool at their disposal to bring the hammer down on naughty auditors and it seems that’s exactly what they’re doing. Wanna alter work papers and then double down when you’re caught?

Withum

OCTOBER 17, 2022

Gross margins, Profits, ARR, EBITDA – the list of financial metrics can go on and on. These metrics are all very helpful in the decision-making and analysis process in determining the trajectory and direction of a startup.Each metric is uniquely designed, and success can vary by industry. In times of economic uncertainty with increased interest rates and inflationary pressures, while these metrics are extremely helpful, the focus becomes increasingly clear – how much cash do we have and how long

Speaker: Sean Yoder

Nonprofits are under more pressure than ever to demonstrate financial accountability while continuing to expand their impact. Traditional budgeting models often fall short, reinforcing silos, limiting flexibility, and stalling growth. Enter collaborative budgeting: a dynamic, team-driven process that enables smarter resource allocation and builds financial resilience at scale.

Patriot Software

OCTOBER 17, 2022

When an employee becomes unemployed, they might qualify to receive unemployment benefits. Unemployment benefits are funded by unemployment taxes, which are paid based on employee wages. But who pays unemployment tax? You or your employees? Types of unemployment taxes Before you can learn who pays unemployment taxes, you need to know about the two types […] READ MORE.

ThomsonReuters

OCTOBER 20, 2022

QUESTION: When participants request hardship distributions under our 401(k) plan, we collect and store documents showing that the participant had one of the immediate and heavy financial needs that are deemed sufficient to permit a hardship distribution. Could we instead allow participants to certify their needs electronically? We already use self-certification to establish that the requested distribution is necessary to satisfy the need.

Withum

OCTOBER 18, 2022

Starting a business is a big step whenever it is done. A question is: when to do it? Is now a good time, or should you wait for the right time? People go into a business for many reasons, with some being started as a part-time activity, when you are laid off and cannot get another comparable job or when you are just ready to do it and need to quit your job.

Advertisement

You wouldn’t keep using a 2009 flip phone - so why settle for outdated close processes? It’s time for an upgrade. SkyStem's Guide to Month-End Close Software walks you through what today’s best tools can do (and what your team shouldn’t have to deal with anymore). Get smart, fast, and a whole lot less stressed when it’s time to close the books.

Patriot Software

OCTOBER 19, 2022

Have you ever seen that tiny box on a W-2 form for statutory employees? Have you wondered, What is a statutory employee? If so, you’re not alone. Many employers without statutory employees aren’t entirely sure what this classification means. But at one point, you may need to hire a statutory employee. Statutory employee definition A […] READ MORE.

Going Concern

OCTOBER 18, 2022

Yesterday the PCAOB made public additional portions of EY’s 2018 inspection report “because the firm did not address certain quality control issues to the satisfaction of the Board within the 12 months following the date of the report.” EY’s 2018 PCAOB inspection report is dated April 28, 2020 and in it, the Board said EY had made marginal improvements in audit quality from the year prior.

Xero

OCTOBER 20, 2022

Accounting has been revolutionised many times over with the emergence of new technology. From calculators to Excel spreadsheets, accountants wouldn’t have gotten far if they weren’t willing to adapt for the good of their practices and their clients. . For Ravi Shah, partner at Vinod Shah & Co , change is being embraced in a practice that was first established by his father in 1989. .

Speaker: Joe Wroblewski, Sales Engineer Manager

Automating time-consuming manual tasks can save your firm hundreds of hours–and thousands of dollars. But it can also have longer-lasting benefits, like helping you attract and retain the next generation of CPAs, and we don’t need to tell you how important that is amid the current generational staffing crisis in the tax and accounting profession. You'll want to save your seat for this new webinar with industry expert Joe Wroblewski, where we'll explore how to: Maximize ROI with Cost-Effective Te

Patriot Software

OCTOBER 17, 2022

Keeping track of your expenses is part of being a business owner. You probably heard it said that you need a separate business bank account in addition to your personal bank account. But, you might not be familiar with a payroll account. What is a payroll account, and should you consider opening one for your […] READ MORE.

Going Concern

OCTOBER 18, 2022

CohnReznick announced a merger with Dallas firm BKM Sowan Horan and the Dallas Morning News took the opportunity to trumpet the happy nuptials of the official accounting firm of the Dallas Cowboys. Dallas Morning News : CohnReznick, the 15th largest accounting firm in the U.S. and the official accounting firm of the Dallas Cowboys, says it has “huge growth plans” for Dallas after combining with a local firm founded in 2010.

AccountingDepartment

OCTOBER 20, 2022

AccountingDepartment.com Co-Founders, Dennis Najjar & Bill Gerber.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

Let's personalize your content