The Hidden World of Sales Tax Crimes

TaxConnex

OCTOBER 15, 2024

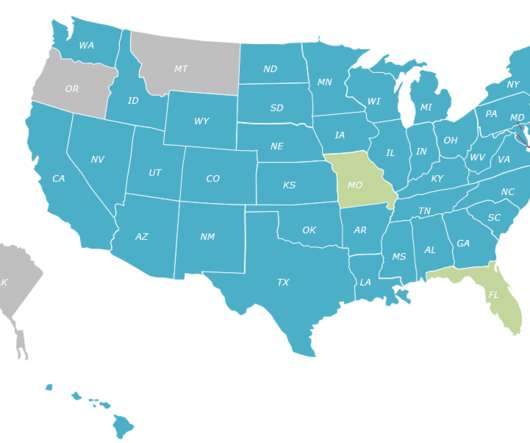

Income tax often seems to grab most of the headlines, but sales tax can make for a hefty crime – and punishment – too. A famous case recently examined in the TaxConnex podcast It Depends episode, “Sales Tax Crimes - Pt. States are watching For Kozlowski, the sales tax matter was a $3.2

Let's personalize your content