Special Report: 2025 Readers’ Choice Awards

CPA Practice

JUNE 30, 2025

million – $4,999,999 $5 million – $10,000,000 Over $10 million Consent Policy (Required) By downloading this content, you agree to our Terms and Conditions.

CPA Practice

JUNE 30, 2025

million – $4,999,999 $5 million – $10,000,000 Over $10 million Consent Policy (Required) By downloading this content, you agree to our Terms and Conditions.

Accounting Today

JUNE 12, 2025

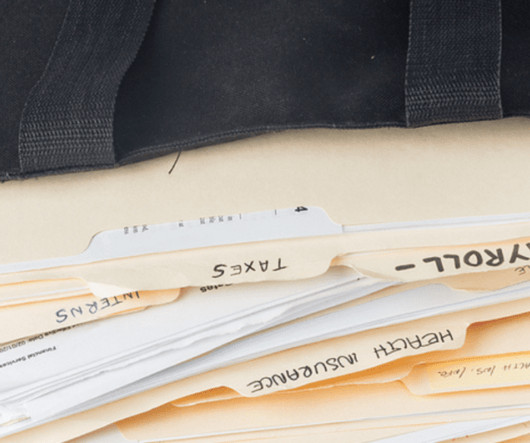

million payroll tax scheme. He failed to collect, account for and pay over payroll taxes to the IRS on behalf of each of these companies from 2014 to 2022, a total of at least $3.5 Oakland, New Jersey: Business owner Walter Hass, of Hewitt, New Jersey, has been sentenced to four years in prison for his role in a $3.5

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

ThomsonReuters

JUNE 27, 2025

At the forefront is the “One Big Beautiful Bill Act,” a high-profile legislative package that could redefine payroll tax policy by permanently extending key provisions of the Tax Cuts and Jobs Act (TCJA) and introducing new exemptions for overtime pay and employee tips. Beyond Capitol Hill, the U.S.

CPA Practice

JULY 24, 2025

OBannon Taxes July 23, 2025 IRS Gives Tax Filing Relief to Those Impacted by May St. Louis Tornado The IRS recently announced tax relief for individuals and businesses located in the city of St. Louis and Scott counties in Missouri after an EF3 tornado caused widespread destruction on May 16. Louis and St.

CPA Practice

JUNE 23, 2025

Jason Bramwell Former Missouri congressman Billy Long was sworn in as the 51st commissioner in the history of the IRS on June 16, saying transforming the culture at the tax agency is at the top of his to-do list. an Arkansas-based oil and gas company, which Democrats said offered non-existent “tribal tax credits.”

CPA Practice

JULY 24, 2025

Before adjusting for seasonal factors, initial claims plummeted by more than 45,000, led by big states like New York and California, as well as in Michigan, Missouri and Ohio—which are home to car factories. With assistance from Chris Middleton.

Anders CPA

JANUARY 7, 2025

In 2025, there are several updates to various payroll tax withholding limits, including Social Security tax and 401(k) elective deferrals. For employees, the minimum wage is increasing in Missouri and Illinois. Some states may require online filing unemployment reports and electronic payment of the taxes due.

Let's personalize your content