4 Accounting Tips to Run a Profitable Professional Services Company

Basis 365

SEPTEMBER 14, 2022

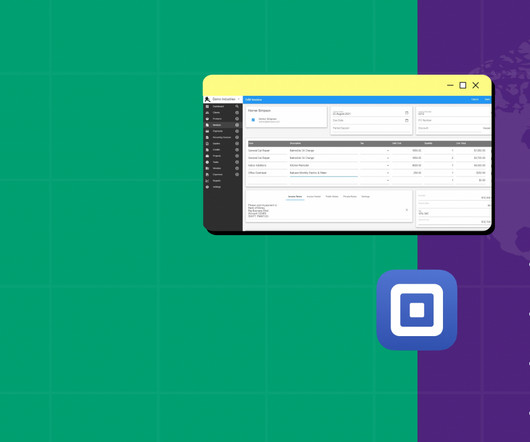

It doesn't matter if you run a marketing agency or a management consulting firm when it comes to managing a profitable consultancy business. For a service-based business to be profitable, it is essential to track time and invoicing accurately. These four accounting tips will increase your consulting company's profitability.

Let's personalize your content