Receive More than $10,000 in Cash at your Business? Here’s What You Must Do

RogerRossmeisl

SEPTEMBER 18, 2023

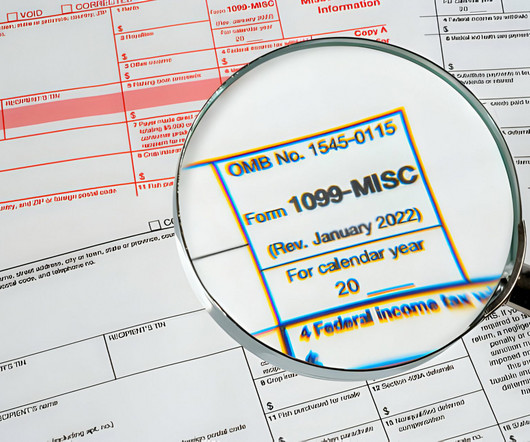

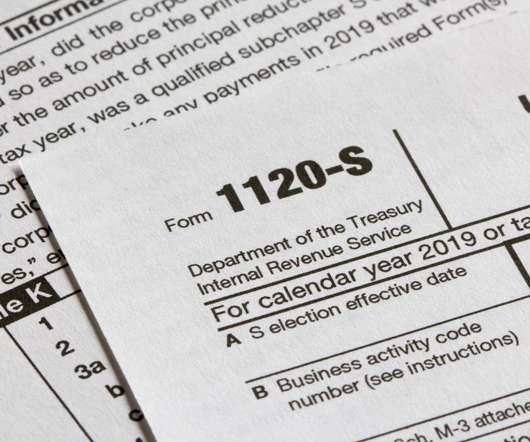

Does your business receive large amounts of cash or cash equivalents? The requirements Each person who, in the course of operating a trade or business, receives more than $10,000 in cash in one transaction (or two or more related transactions), must file Form 8300. The post Receive More than $10,000 in Cash at your Business?

Let's personalize your content